What does it take to build a thriving biotech venture in Latin America? With investor interest surging and success stories like NotCo and Bioceres gaining international recognition, the region is becoming a hub for biotech innovation. Yet, despite growing opportunities, biotech startups in LATAM face unique challenges—from funding constraints to infrastructure gaps.

Our research finds that one factor consistently drives success: the founding team.

- Founders with 5+ years in consulting, business development, or management drive success by navigating LATAM's unique biotech challenges.

- PhDs dominate CSO/CTO roles for scientific rigor, while MBAs in CEO/COO roles bring strategic and operational expertise.

- As ventures grow, leadership priorities shift—early CEOs focus on securing funding, while later-stage leaders drive scaling and commercialization.

- The strongest teams balance scientific expertise, business strategy, and execution, accelerating tech validation and market entry.

Strong teams overcome infrastructure and funding gaps through strong networks and partnerships.

Written by Romina Horianski

The number of biotech companies in Latin America has increased in recent years, and so has investor interest. According to 2024 LAVCA Trends in Tech report,biotech ranks among LATAM's top 10 tech verticals by deal volume. The Inter-American Development Bank's 2022 report, Deep Tech: The New Wave, highlights the long maturation timeline for deep tech ecosystems in the region but projects substantial growth, with the sector potentially expanding 20-fold over the next decade. Additionally, our study on venture capital activity in Brazil found that biotech investments have increased by 60% over the past ten years.

Success stories like NotCo and Bioceres (each valued at over $500M), Biotimize and Phagelab (each exceeding $100M), and the recent acquisition of Neoprospecta by bioMérieux are fueling industry momentum. These milestones are opening doors for new business and partnership opportunities across the region. With investor interest rising and success stories emerging, the question becomes: What drives the success rate of scientific ideas and technologies as ventures in LATAM?

While there isn't a single definitive answer, we identified what is often considered the most critical factor—the cornerstone that influences all others—especially in an emerging biotech ecosystem like LATAM: the founding team.

Why Focus on Founding Teams?

When investors assess a biotech startup’s potential, the founding team is one factor that stands above the rest.

This focus aligns with venture capital decision-making frameworks, as well as insights from Jim Collins' Good to Great: Why Some Companies Make the Leap and Others Don’t. In fact, when VCs assess the venture’s chances of success in their due diligence, they look for signals that reduce uncertainty and risks in the analyzed ventures - which in the case of early-stage ventures is commonly centered on founding teams (Gompers et al., 2020). Among tangible metrics to evaluate success, a founding team's prior industry experience is one of the most critical, particularly in sectors like biotech where regulatory expertise and commercialization pathways are complex (Nielsen, 2015).

Furthermore, in emerging ecosystems, where (i) supporting infrastructure, such as leasing laboratories for technology development, is scarce, (ii) the R&D sector remains limited, reducing opportunities for biotech acquisitions, and (iii) specialized VC funds are still developing and constrained by local macroeconomic challenges, a startup's success depends far more on its founding team. Specifically, founders' industry networks, market access, strategic and operational expertise, and ability to attract top talent become critical—all of which stem from their professional experience.

By analyzing the profiles of successful founding teams, we aim to provide valuable insights for stakeholders in the LATAM ecosystem. Our goal is to shed light on a crucial aspect of successful company formation in the region: the ideal configuration of a founding team.

Hallmarks of Biotech Success

Success in biotech ventures is multifaceted and depends on various factors. While academic literature offers no single definition, we adopt Jim Collins' perspective: "the ability to deliver exceptional, sustained results over a long period, outperforming competitors and market averages."

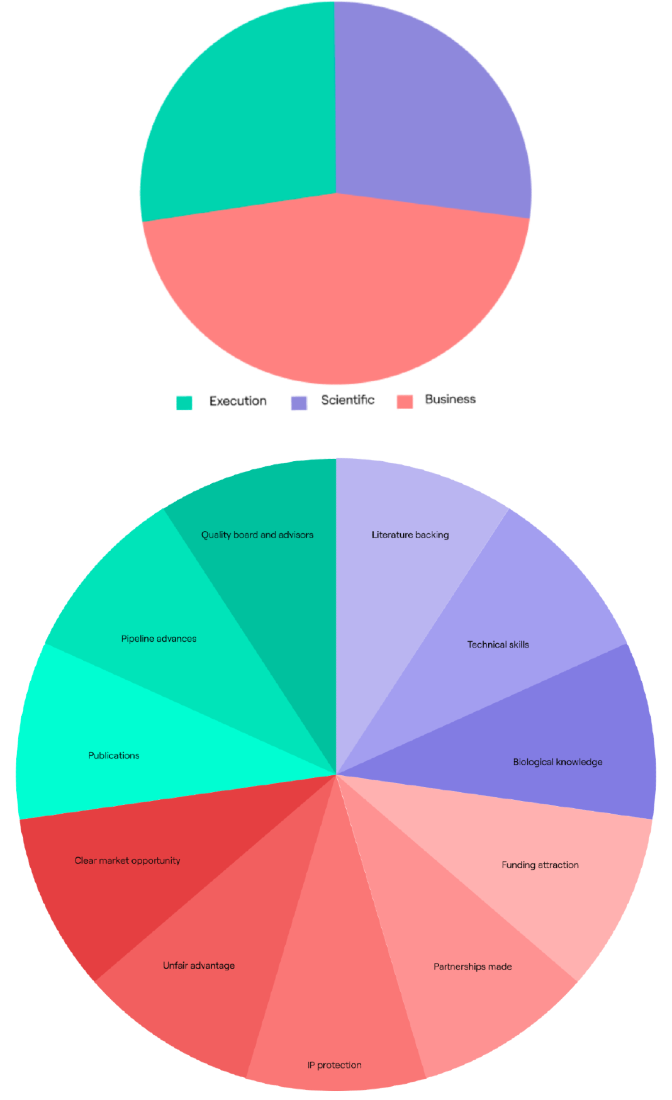

To illustrate the key hallmarks of biotech venture success, we categorize them into three core capabilities: scientific, business, and execution (Figure 1 ).

- Scientific capability

- Biotech is fundamentally driven by scientific discoveries. A venture’s success depends on the biological and technical validity of its technology, supported by peer-reviewed research and the founders' scientific track record. Strong technical expertise is also essential for advancing the technology from concept to application.

- Business capability

- As any other type of business, knowing which unmet need and market to target, how to commercialize a technology, how to attract partnerships (see our Partnering with Pharma playbook), what are the exit strategies, and how to gain competitive advantage through patents or network activation are a must for new entrants in a highly regulated and fragmented sector.

- Execution capability

- A promising technology or idea is meaningless if it remains on a drawing board, demo day stage, or pitch deck. Rapid execution minimizes investment risk and accelerates growth. From the technical aspect, publication of tech validations and pipeline advances are needed for tech de-risking and value gain. From a track record perspective, being able to attract respected names in the industry to back the company translates to a high capacity of delivering results, as this increases the chances for partnerships and connection opportunities.

One way to evaluate key indicators of a venture’s success is by analyzing the number of investment rounds secured. Venture capitalists assess companies based on market demand, founding team strength, and a clear path to meaningful milestones. Securing multiple rounds of institutional funding signals investor confidence and a company's ability to execute its vision.

In this context, we defined groups “on the track to success” as those that have secured at least two rounds of funding from institutional investors (VCs or private equity), with the second round being a seed or post-seed investment. To maintain focus, we did not consider other success indicators in our dataset, treating them as outliers for this analysis.

Our evaluation is based on the following premises:

- If a company receives a second (or later) round of investment, it suggests the company has met key milestones, demonstrated a viable technology application, and holds a competitive advantage.

- If the company has many pre-seed rounds, it implies that the execution capacity is not well established and it holds a high risk for success.

While funding is a critical enabler of success, it is not success itself. Additionally, companies that have not yet received any institutional investment can be as, or more, successful than those that have received funding. In fact, there are several such cases in LATAM - Genera (acquired by Dasa in 2019) and Zoovet (acquired by Ceva Sante Animale), among others. However, for the purpose and premises of our scope, we did not incorporate these cases in our analysis.

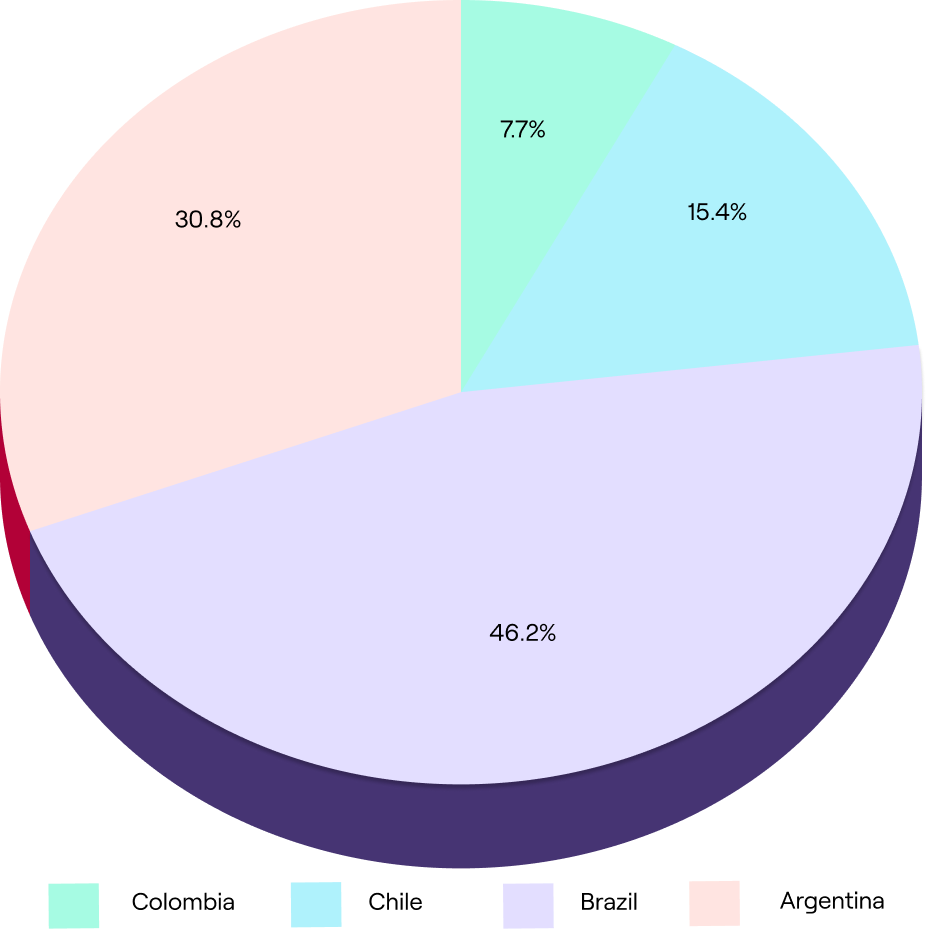

Using data gathered from Crunchbase, we filtered LATAM biotech companies based on our investment criteria, narrowing the dataset to 11 ventures from different countries across the region (Figure 2).

Winning Biotech Teams in LATAM

Biotech founding teams are composed of two key layers:

- Hard skills: Technical knowledge, educational background, and industry experience.

- Soft skills: Traits such as resilience, discipline, leadership, and adaptability.

While there is a high correlation between soft skills and success, our study targets the founders’ professional trajectory up until the creation of the biotech venture, from publicly available information from websites and LinkedIn profiles. To translate founder trajectories into actionable insights for new biotech ventures, we analyzed the following factors across our cohort:

- C-level positions (CEO, CSO, CTO, COO)

- Bachelor’s degree fields

- Graduate education

- Professional experience (industry and years of experience)

Educational & Industry Background Analysis

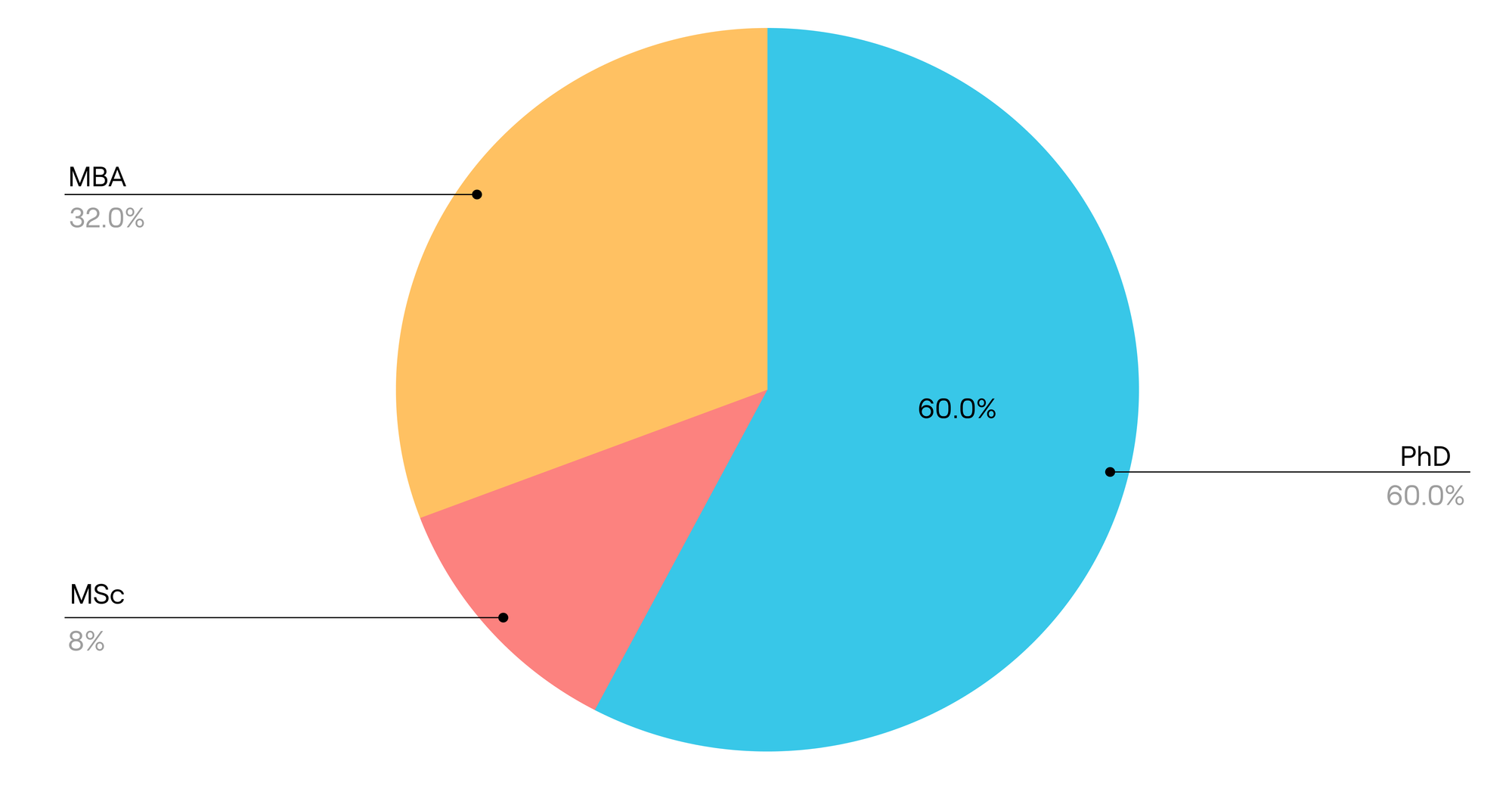

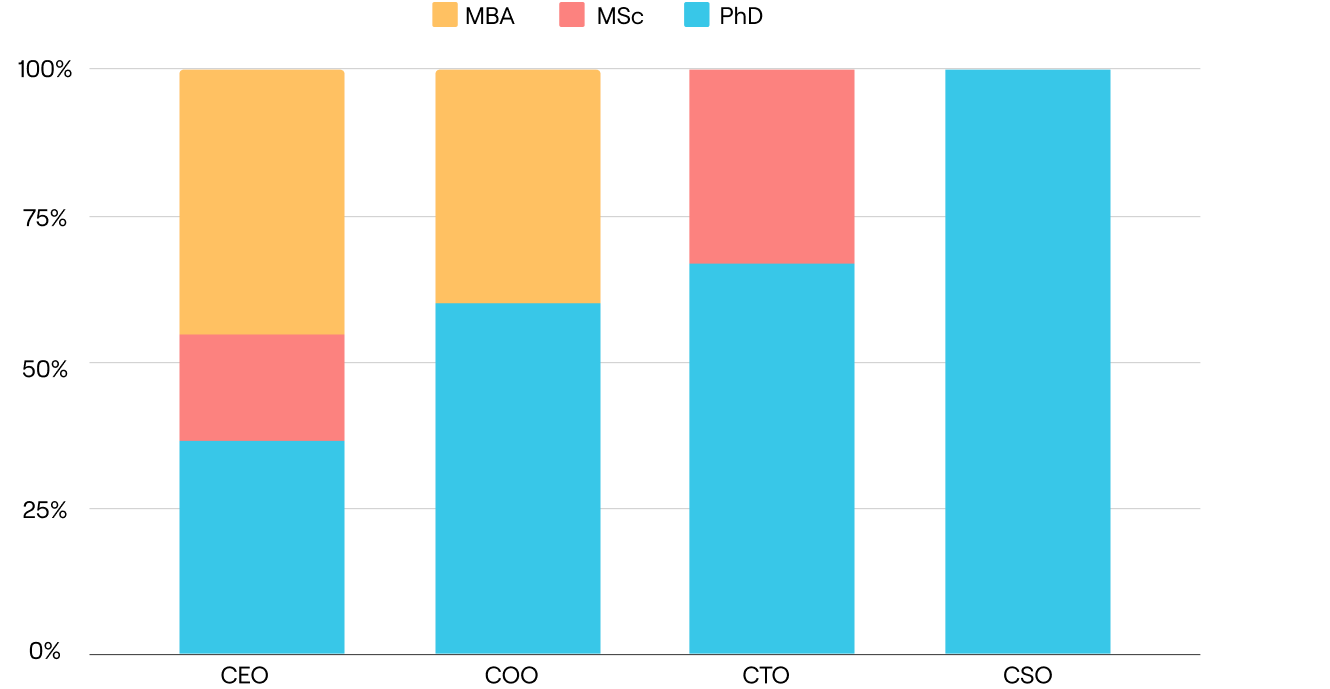

As expected in the biotech sector, 60% of founders hold a PhD, followed by 32% with an MBA and 8% with an MSc (Figure 3). These degrees align with leadership roles within biotech companies (Figure 4):

- CSO & CTO roles are predominantly held by PhDs, highlighting the importance of deep scientific expertise for managing R&D, intellectual property (IP) strategies, and product development.

- CEO & COO roles are more frequently held by MBAs, which correlate with strategic decision-making, leadership skills, and business operations expertise.

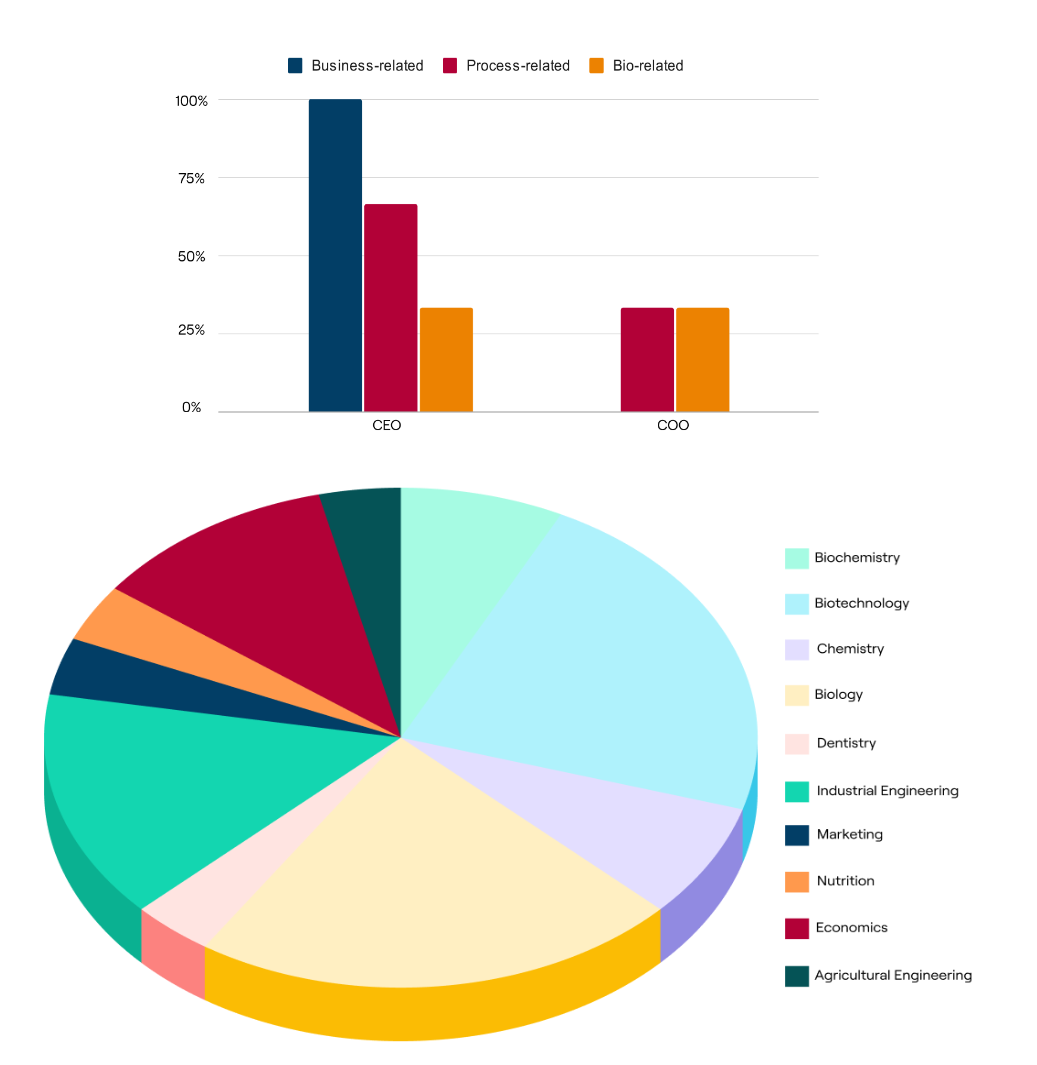

When analyzing the academic backgrounds of MBA-holding CEOs and COOs (Figure 5), we found most CEOs have business-related degrees (e.g., economics), followed by process-related degrees (e.g., industrial engineering), and then bio-related degrees. This contrasts with COOs, who typically come from process-related or bio-related fields. Although a business background resonates with operational roles in a company, process-related backgrounds stand out given their capabilities on optimizing complex production systems considering supply chain, regulatory compliances, logistics & distribution, and leading cross-functional teams, all while maintaining cost efficiency.

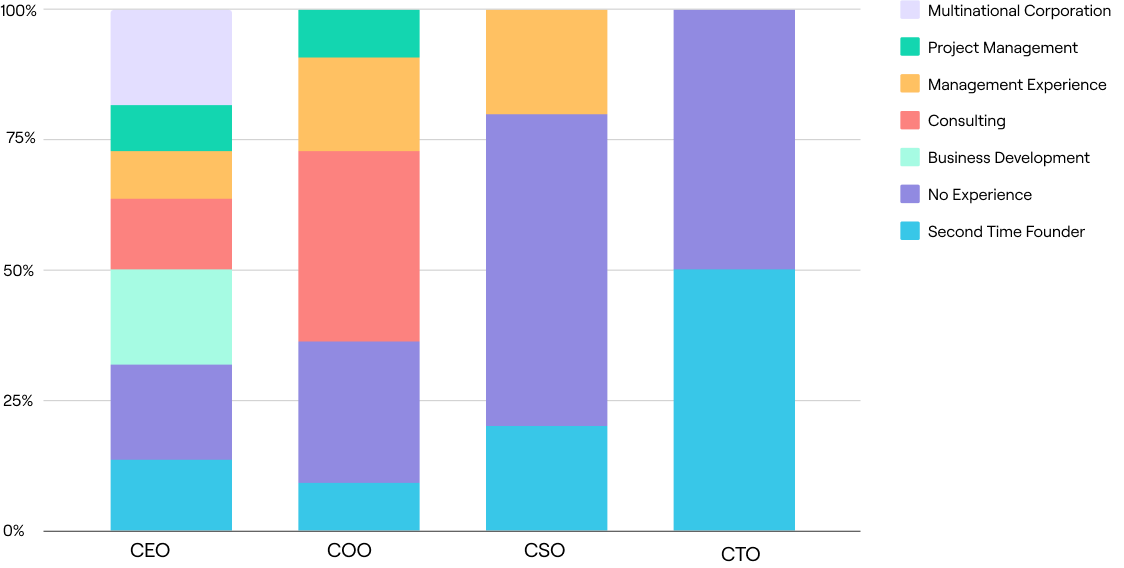

To further analyze the profiles of biotech founders, we examined their professional experience beyond academic roles (Figures 6 & 7). It’s important to note that (i) a founder may have more than one type of professional background, and (ii) we did not consider academic qualifications alone - graduate student, PI or researcher - as professional experience, as we aimed to identify other relevant experiences for executive roles in venture creation and growth. In this context, a founder with only an academic background was considered 'inexperienced' from a market or industry perspective.

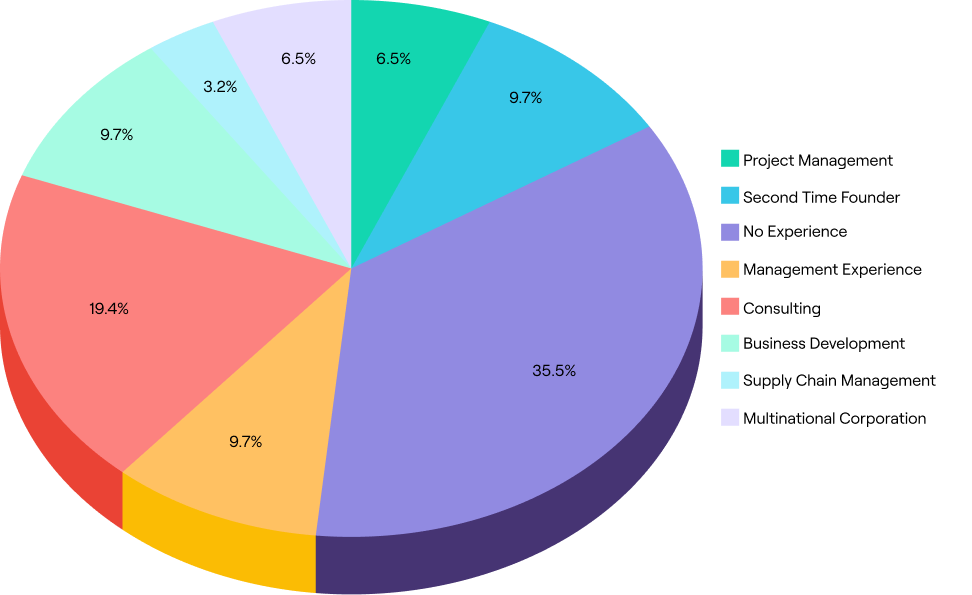

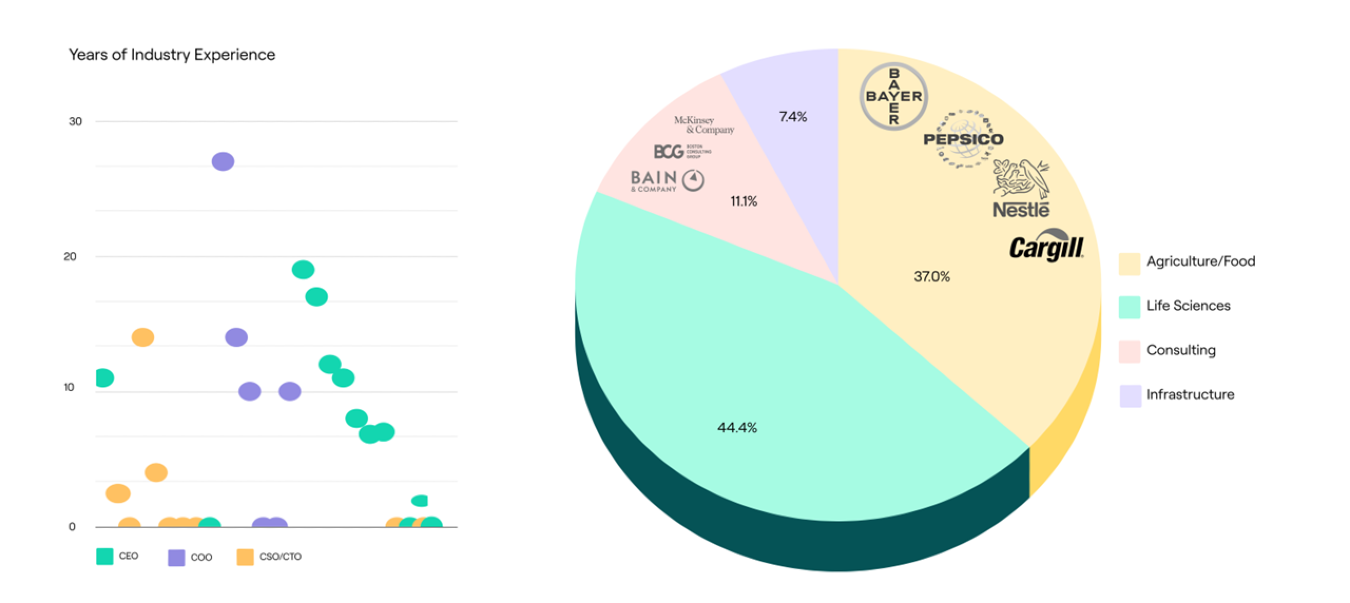

Approximately 64% of founders had prior experience in management-related roles, including consulting (~20%), business development (~10%), general management (~10%), project management (~7%), and supply chain management (~3%). Meanwhile, around 10% were second-time founders, and 6.5% had experience working in multinational corporations. Less than 36% had no prior market or industry experience.

Strategic leadership positions are predominantly held by founders with at least five years of industry experience. Many of these executives have backgrounds in top consulting firms such as McKinsey & Co., Bain & Co., and BCG, or in major agriculture/food companies like Bayer, PepsiCo, Nestlé, BRF, and Cargill (Figure 8).

Analyzing the professional profiles of biotech executives, we found that successful CEOs come from diverse backgrounds, with notable representation from second-time founders and professionals with business development experience—both reflecting strong entrepreneurial expertise and strategic acumen.

In contrast, COOs have a stronger presence in consulting and management roles, emphasizing operational and organizational expertise. Notably, COOs have a lower proportion of second-time founders compared to CEOs, suggesting that while CEOs bring broader entrepreneurial and strategic perspectives, COOs are more focused on hands-on management of processes and structures within the industry.

Meanwhile, CSO and CTO roles show a significant proportion of individuals without prior industry experience. While some have backgrounds in management or entrepreneurship, these cases are less common, reinforcing the expectation that these roles prioritize deep technical expertise over business or operational leadership.

Evolving Team Composition in Biotech Ventures

Biotech team composition is dynamic, evolving as the company progresses through different stages of growth. Each stage requires distinct skill sets, and founding CEOs or other executives may transition into new roles to optimize the company’s success. As illustrated in our Entrepreneurial Scientist Playbook “Operationalizing Your Therapeutics Spinout”) , leadership roles shift focus to align with the company’s changing priorities.

Early Stage: Laying the Foundation

- CEOs & Business Leaders:

- Focus on securing funding through venture capital, grants, and partnerships while crafting a compelling vision to attract investors and top talent.

- CSOs & Scientific Executives:

- Lead preclinical studies, patent strategy, and data interpretation, ensuring scientific rigor and innovation.

- COOs & Operational Leaders:

- Establish laboratory protocols, recruit core teams, and navigate regulatory requirements.

Growth Stage: Scaling & Expansion

- CEOs & Business Leaders:

- Shift towards expansion strategies, including IPOs, licensing deals, and global market entry.

- CSOs & Scientific Executives:

- Oversee clinical trials, regulatory approvals, and pipeline decisions.

- COOs & Operational Leaders:

- Scale production facilities, enhance infrastructure, and expand teams to support commercialization.

As a biotech company matures, leadership roles adapt to new priorities, ensuring that the right expertise is in place at every stage. This fluidity in team composition is a key driver of long-term success.

LATAM's Biotech Landscape

The LATAM biotech ecosystem is at a turning point, with increasing investor interest, a rise in innovative startups, and success stories like NotCo, Bioceres, Genera and Neoprospecta showcasing the region’s potential. However, challenges such as limited infrastructure and R&D value chain, regulatory hurdles, and limited venture capital networks remain significant, slowing down most biotechs’ milestones achievement and value creation.

We believe founding teams are central to overcoming these obstacles. Teams with industry and consulting experience, strong networks, and a balanced mix of scientific, business, and operational expertise are better equipped to navigate LATAM’s complexities. Moreover, they can leverage opportunities beyond the region, expanding into more mature markets—a crucial step for long-term success.

In fact, accessing established markets provides companies with greater funding opportunities, advanced infrastructure and valuable partnerships. By building strong, adaptable founding teams and embracing international growth, LATAM’s biotech sector can achieve sustainable progress and meaningful impact, creating a more fruitful ecosystem for novel biotech companies.

Hidden Layers Team

| Lead | Lauren Stanwicks |

| Team Members | Romina Horianski, Anisha Sharma, Pranita Atri, Lauren Clubb, Samantha Fabregat |

| Graphic Design | Bea Portez, Isabella Altillio |

References

- McCarthy, P.X., Gong, X., Braesemann, F. et al. The impact of founder personalities on startup success. Sci Rep 13, 17200 (2023). https://doi.org/10.1038/s41598-023-41980-y

- Francesco Ferrati, Phillip H. Kim and Moreno Muffatto. Patterns of Successful Founding Team Composition and Funding Outcomes. 2023.

- Peña, Ignacio; Jenik, Micaela. Deep tech: the new wave. 2023

- 2024 LAVCA Trends in Tech. Insights on the Venture Capital Industry in Latin America.

- Paul A. Gompers, Will Gornall, Steven N. Kaplan, Ilya A. Strebulaev. How do venture capitalists make decisions? Journal of Financial Economics. Volume 135. Issue 1.2020. Pages 169-190. ISSN 0304-405X.

- Marrus, S.K., Blaho, J.A. Increasing the success potential of promising biotech companies. Nat Biotechnol 41, 154–155 (2023). https://doi.org/10.1038/s41587-022-01627-1

Data Sourcing

The information in this report is based on data and trends from Crunchbase as of March 2025. Due to the dynamic nature of the biotech industry, some details may change following publication.