Highlights:

- Brazilian VC funding in biotech is on the rise, with approximately 50 firms investing in a diverse range of biotech sectors.

- Top players like GRIDS Capital, Vesper Ventures, and LifelyVC are driving biotech investments, with a focus on early-stage ventures.

- Biotech investments predominantly target healthcare & life sciences, with AI/ML emerging as a key technology

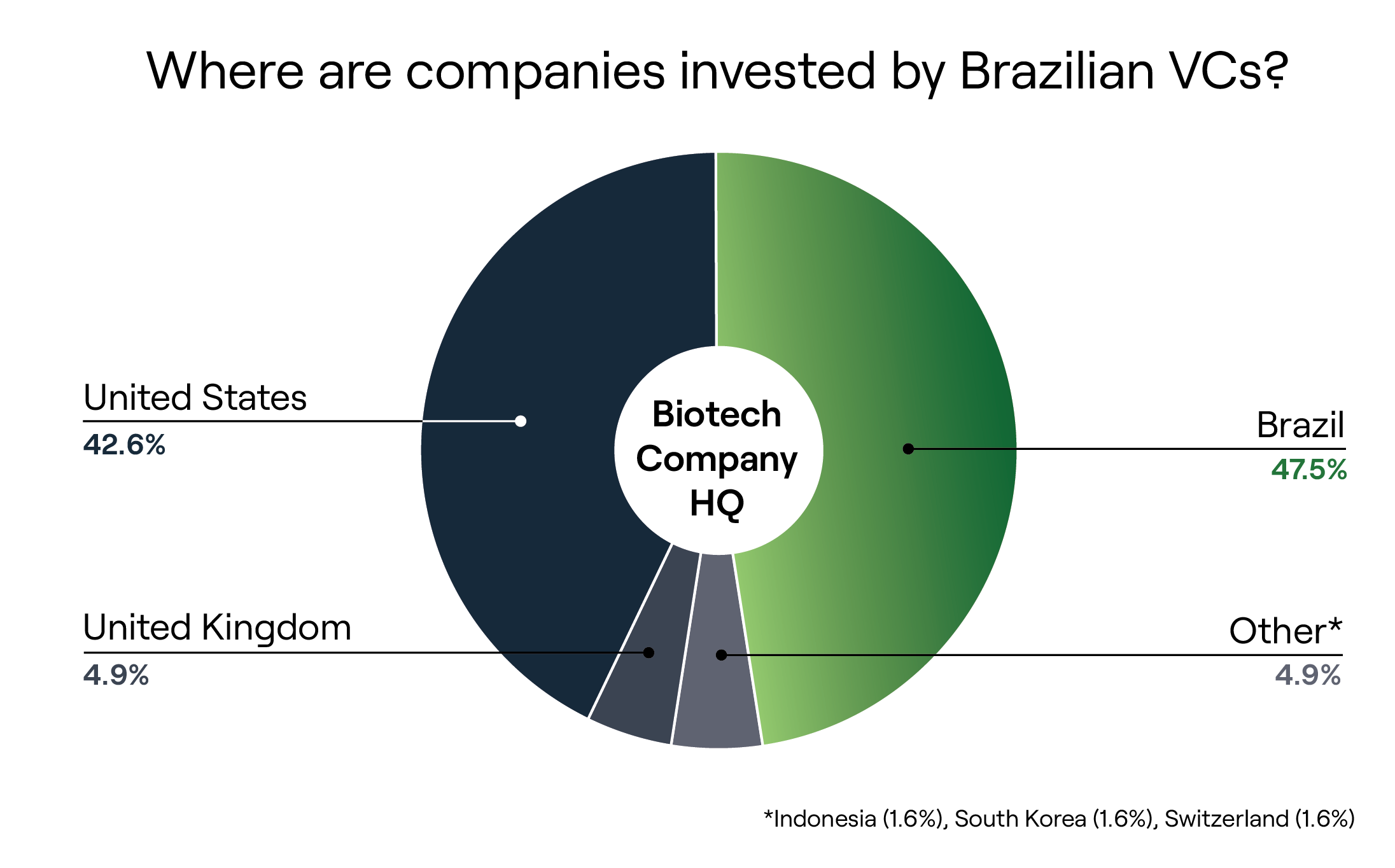

- Brazilian biotech startups are gaining considerable attention, with approximately 50% of investments originating domestically. This underscores Brazil's increasing appeal as an investment hub.

- A notable portion of Brazilian venture capital investments is directed towards US-based biotech companies, likely influenced by the advanced stage of development in the US biotech sector.

- Strategies like internationalization of invested biotech companies are being pursued to tap into more mature markets and increase chances of success.

Venture capital (VC) funding serves as a critical catalyst for innovation. In Brazil, the VC landscape is gaining momentum, with a particular focus on deep technology investments. Deep tech companies develop technology solutions based on complex scientific or engineering problems. However, it's important to understand that deep tech is a broad and diverse category, covering many different industries, each with unique challenges and opportunities.

Among these diverse sectors, biotechnology stands out as a particularly dynamic and multifaceted domain. Biotech ventures cover a wide range of innovations, including pharmaceuticals, medical devices, and agricultural biotechnology. However, each area within biotech faces unique challenges, such as different regulatory requirements, varying time-to-market dynamics, technology risks, and stages of market maturity.

Recognizing this diversity, we explore the complex landscape of Brazilian VC funds specializing in biotech investments in this article. We will examine key trends, notable players, and emerging opportunities to give investors, entrepreneurs, and stakeholders a clear overview of the biotech investment scene in Brazil.

Data was sourced from Crunchbase in February 2024.

Biotech Investment by Brazilian Venture Capital Funds

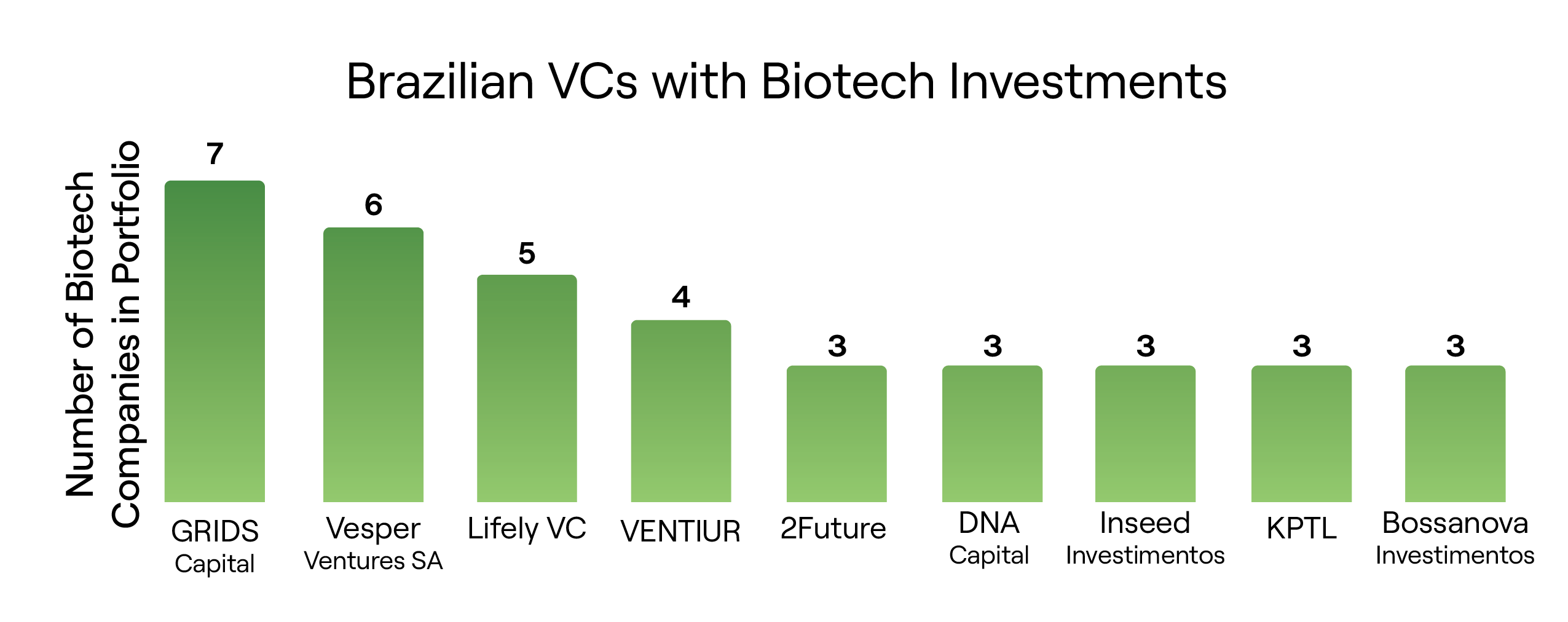

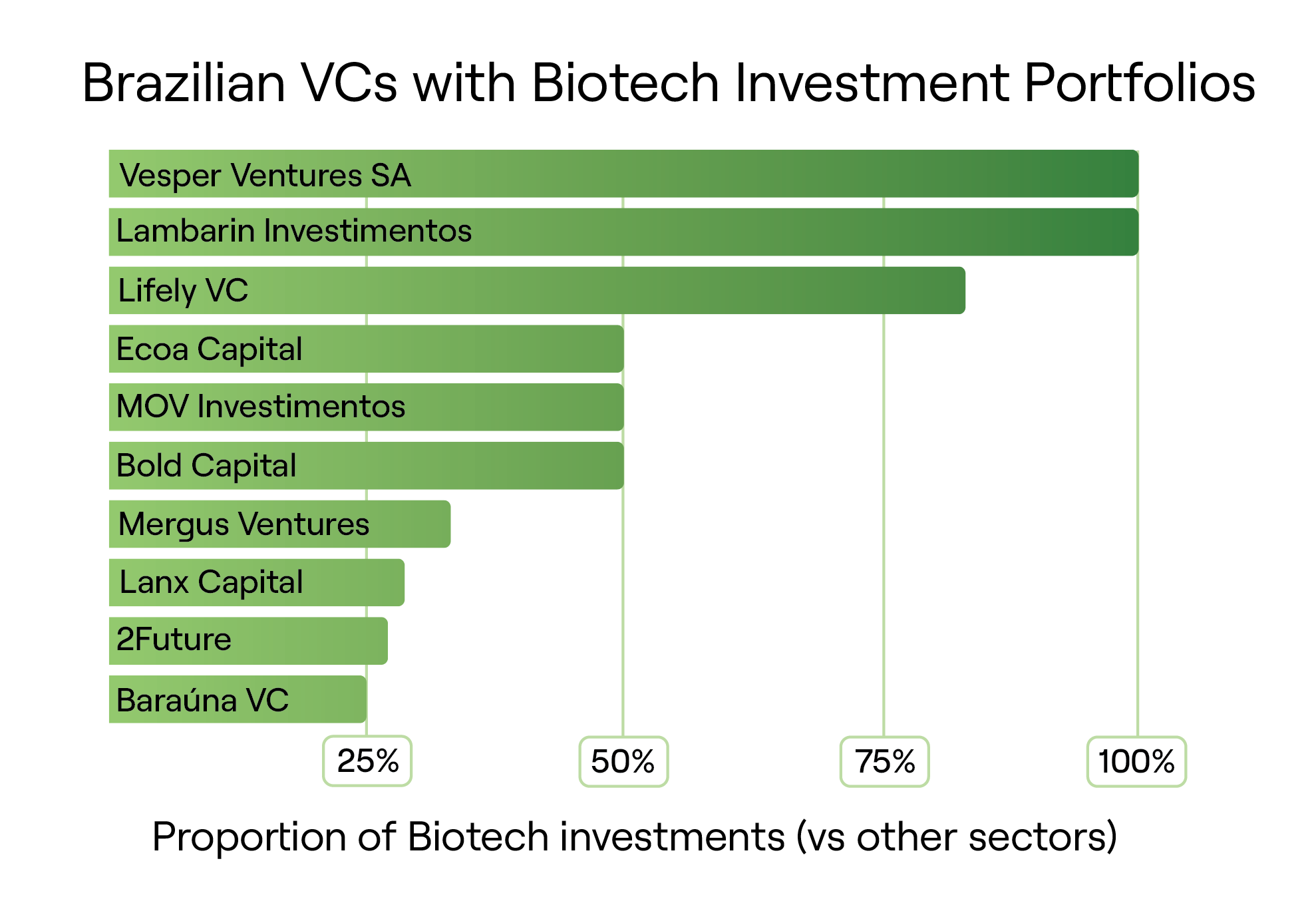

The Brazilian venture capital landscape includes about 50 firms investing in biotech companies. We identified the top 20 funds based on the number of biotech investments they have made (Figure 1). Among these, the leading three are GRIDS Capital, Vesper Ventures, and LifelyVC. Furthermore, from a relative quantitative perspective, we have conducted a comparative analysis of these firms to discern their specialization in biotech investments (Figure 2). The top three firms that specialize in biotech investments are Vesper Ventures, Lambarin Investimentos, and LifelyVC.

Top Funds

GRIDS Capital, with a fund size of $161.1 million, was founded in 2016 and is headquartered in Sao Paulo. It operates as a deep tech venture capital firm, with investments spanning various sectors including AI, Robotics, Life Sciences, Tech Infrastructure, Energy, and Advanced Materials. While ranking first in biotech investments, this sector constitutes approximately 10% of their overall investment portfolio. Notable recent investments include Doloromics, Nabla Bio, and Anagenex. One of their portfolio companies, Fauna Bio, conducts genomic data comparisons across species to identify drug targets, leveraging animal hibernation science. Fauna Bio recently collaborated with drugmaker Eli Lilly to explore drug targets for obesity by studying the genetics of animals thriving in extreme conditions.

Vesper Ventures, founded in 2018 and based in Florianopolis, operates as a biotech-focused venture fund and venture builder. While ranking second in the number of biotech investments, all of its investments are focused on the biotech sector. Besides investments in companies such as Symbiomics, Cellertz Bio, and InEdita Bio, Vesper Ventures has recently invested in agriculture biotechs Hapiseeds and Reddot Bio. Aptah Bio, one of their portfolio companies, is a Brazilian biotech specializing in RNA therapeutics for age-related diseases like cancer and neurodegenerative conditions. Aptah Bio's molecule is a pioneering compound ensuring accurate RNA processing of multiple proteins, serving as a template for RNA quality control via a patented platform.

LifelyVC, headquartered in Rio de Janeiro, focuses on early-stage startups aiming to eliminate the use of animals in global supply chains, primarily in the food and materials sectors. In addition to investments in companies like NuCicer and Bond Pet Foods, LifelyVC has recently invested in several others such as Change Foods, Aqua Cultured Foods, and Gelatex. One of their portfolio companies, Lokifoods, hails from Iceland and has developed technology for creating plant-based seafood, contributing to a more sustainable food chain.

Emerging Funds

Although not among the top five firms, Green Rock, a healthcare-focused fund established in 2017, has started investing in biotech companies like NAIAD Drug Development and miRscience Therapeutics. MiRscience Therapeutics, a Brazilian seed-stage biotech company, specializes in developing artificial microRNAs to target aging diseases like sarcopenia (muscle loss) using their patented MIR-discovery platform. These investments are not yet reflected in Crunchbase's datasets.

Investment Stages

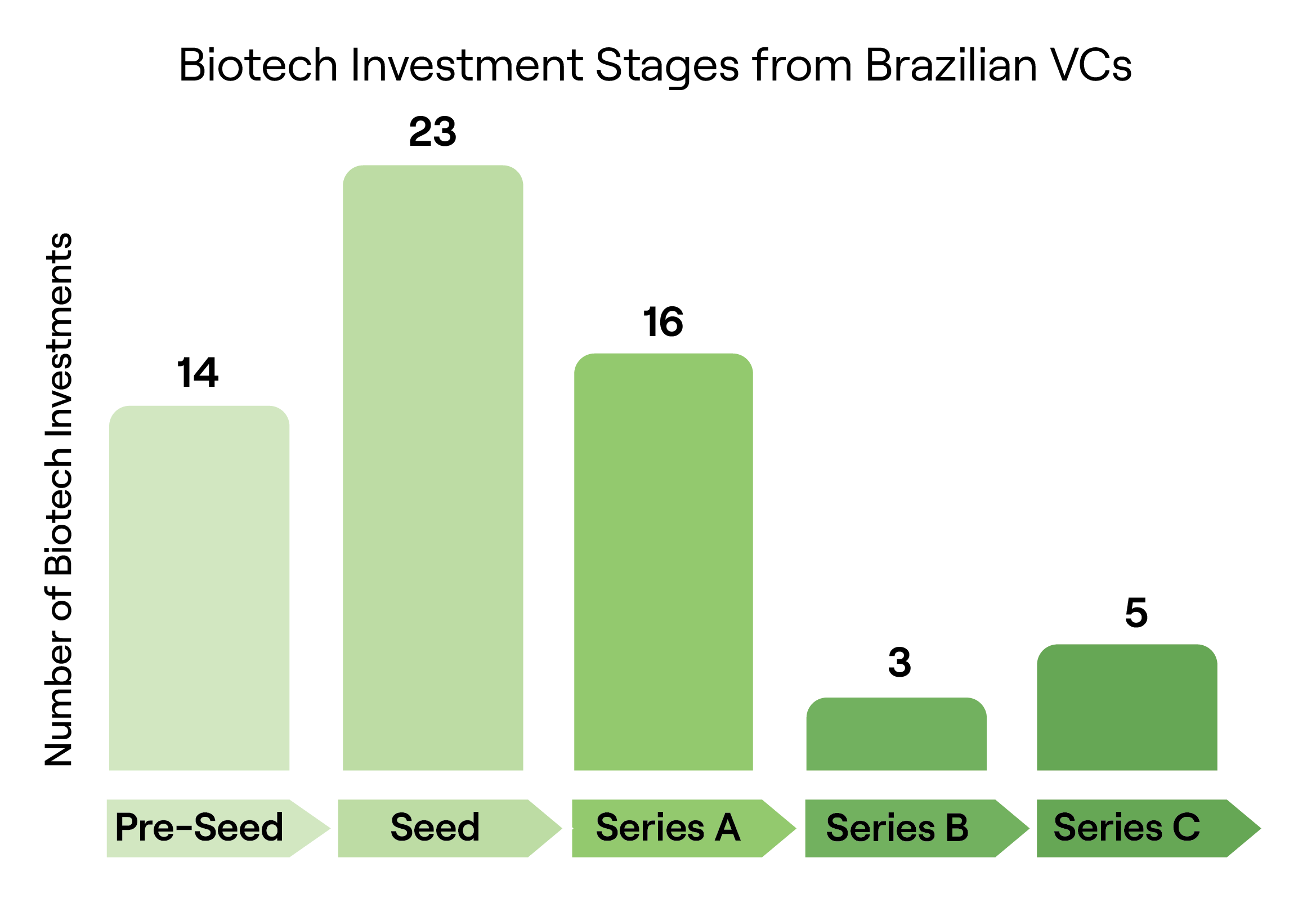

Biotech investments by Brazilian VC firms predominantly target early-stage ventures, with seed investments leading the pack, followed by pre-seed and Series A (refer to Figure 3).

Investments Over the Last Decade

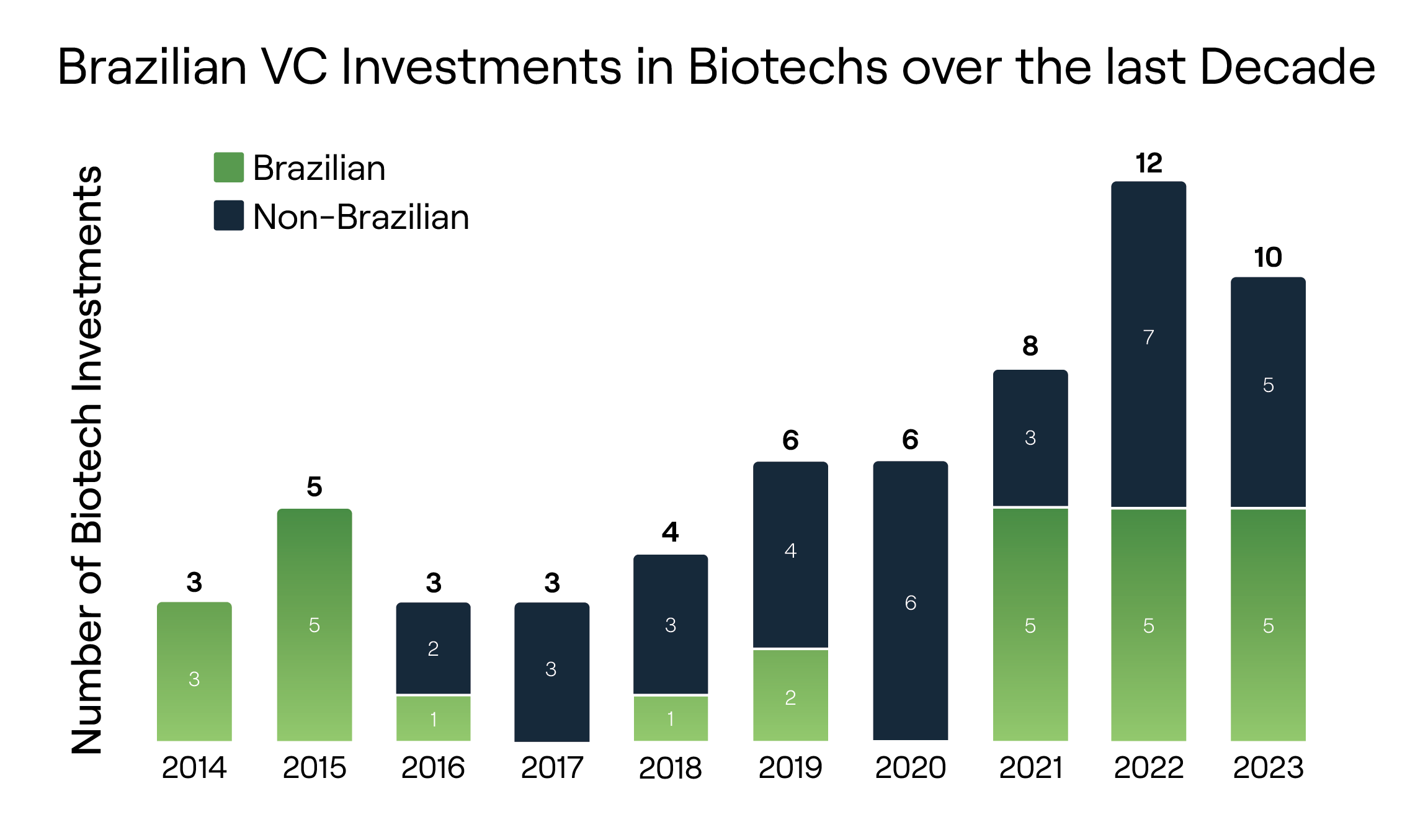

As expected, the number of investments by Brazilian VC funds in biotech companies, both domestic and international, has steadily increased over the past decade. This trend aligns with published reports highlighting the growing opportunities within the Latin American (LATAM) biotech ecosystem.

Brazilian VC Investment Activity in Brazilian Biotech Companies

Based on our data analysis, approximately 47% of the biotech companies invested in by Brazilian VC funds are based and operated in Brazil (Figure 5). The United States follows closely behind, receiving around 42% of these investments. This distribution may be attributed to the advanced maturity of the US biotech market, potentially offering lower risks concerning companies' business development and operations.

Factors Influencing Investment in Brazilian Biotech Startups

After presenting our data to specialists in Brazil, two major potential explanations have emerged for the limited presence of VC investing in local biotech companies:

- Limited Maturity of the Local Biotech Market: This extends beyond the sheer number of biotech companies and encompasses the entire value chain necessary for establishing sustainable businesses. For instance, there is a lack of local R&D facilities as well as a shortage of industry-trained human capital. Additionally, regulatory constraints, such as IP protection delayed approval speed, and limited clinical trial structures, such as low density of CRO and a lagging speed of the whole process, contribute to the lack of competitiveness of local new drugs or technologies to market.

- Lack of Downstream Capital: When investing in Brazil, there is often limited capital available for subsequent funding rounds. This may be due to a lack of successful biotech stories and limited trust from larger Limited Partners (LPs) in the local industry. Compared to mature markets like the USA, Brazil lacks robust secondary markets, local biotech IPOs, and M&A activities, resulting in fewer late-stage biotech companies emerging from Brazil.

Top Investment Areas and Technologies for Brazilian Venture Capital

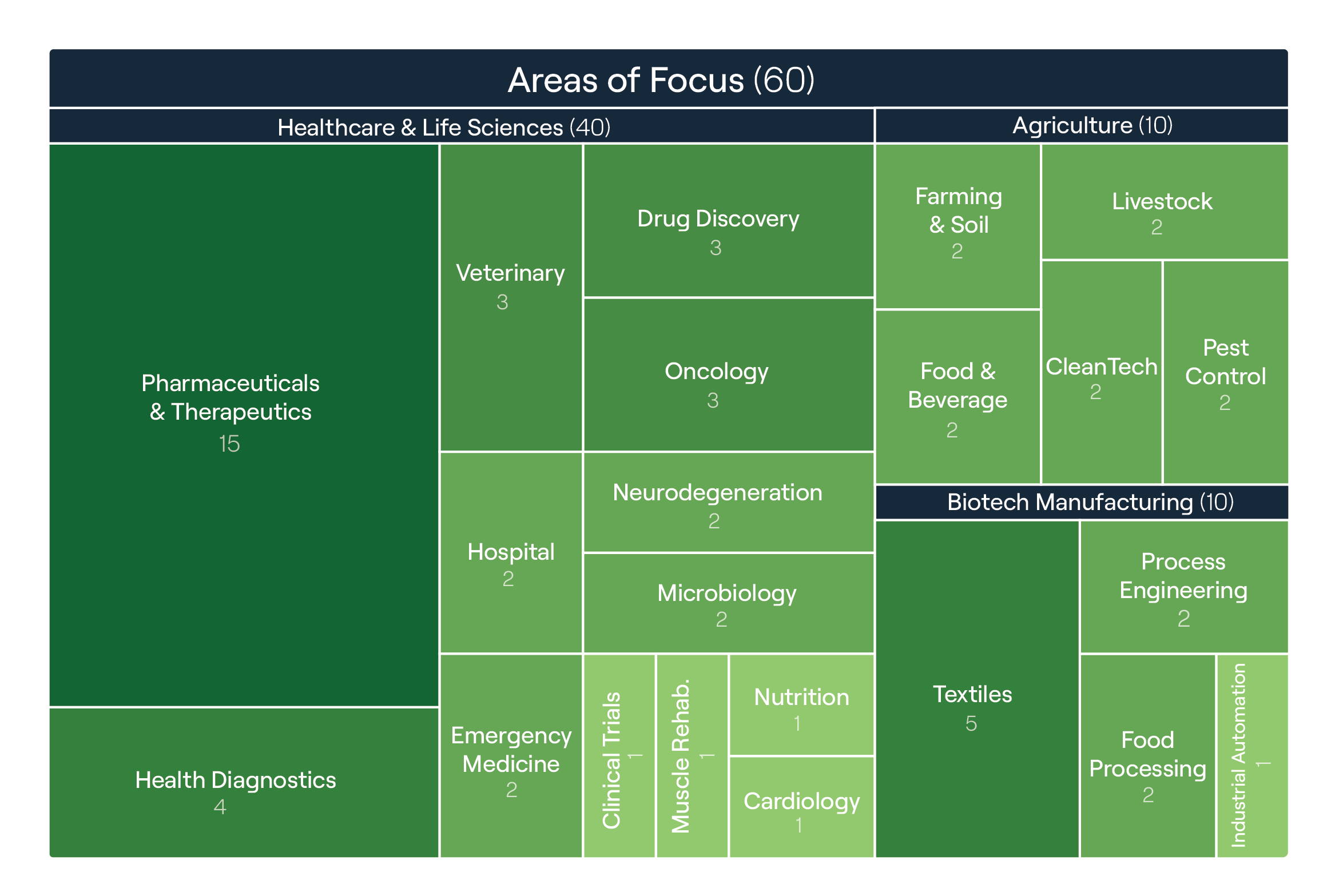

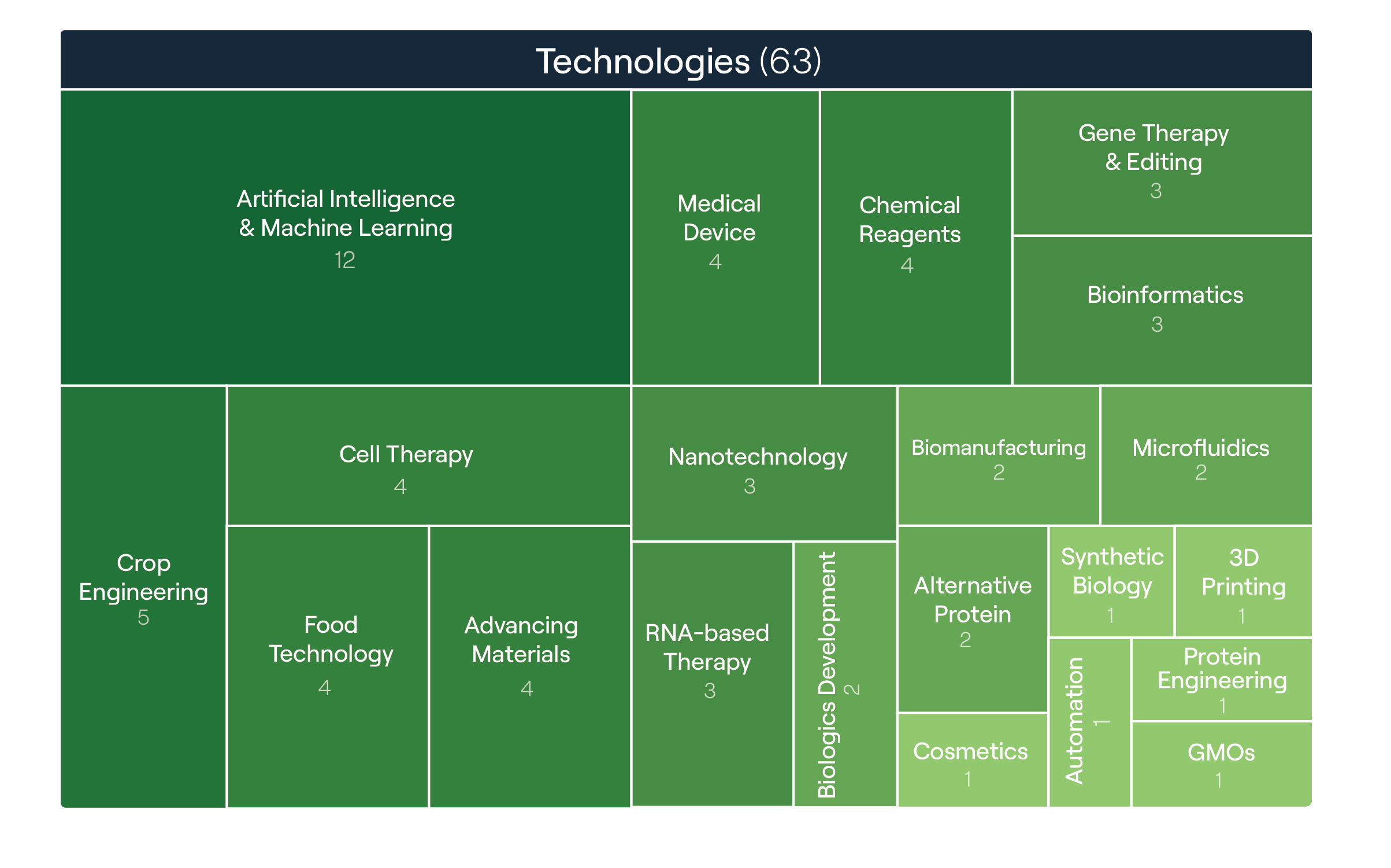

To identify prevailing trends in biotech investments, we analyzed data from the cohort of invested companies, categorizing their areas of focus and technologies (Figure 6). The size of each square represents the frequency of appearances within the biotech investment cohort.

Three primary focus areas emerged: healthcare & life sciences, agriculture, and manufacturing (Figure 6). Healthcare & life sciences stood out, surpassing both AgTech and manufacturing. Figure 7 segments the technologies used by these companies, regardless of their focus area.

Healthcare & life sciences emerged as the primary area of interest, with pharmaceuticals and therapeutics leading within this sector. Artificial Intelligence (AI) and Machine Learning (ML) were the most commonly used technologies, followed by crop engineering. Notably, most pharmaceutical and therapeutics biotech companies rely on AI as their core technology, with cell therapy, gene therapy, and RNA-based therapies as secondary technologies.

The AI/ML presence in our cohort comes in direction with global reports on IA for Pharma and Biotech market size, estimated at a value of USD 850.0 million in 2021 and with a CAGR of 30.51% (Precision Milestone). Additionally, external data indicates that AI-driven drug discovery has been in the biopharma companies radar, being a rapid rise in partnerships between traditional companies and AI-driven drug companies (Mckinsey & Co., 2022). Yet, despite the growing numbers and excitement on AI in Biotech, most of the technology application is still in its preclinical stages, having yet to prove itself.

Taken together, the data reflect not only Brazil's competitiveness, but also its ecosystem gaps and opportunities for improvements. For instance, early clinical stages are difficult to be made in Brazil, mainly due to its regulatory environment, lack of structure and an incipient CRO market. Corroborating with this scenario, an MIT Industrial Performance Center article states that “By the time a global trial might be approved in Brazil, the trial is almost over. This represents a lost opportunity for Brazil on many fronts” (Reynolds 2016). Despite the approval process taking the longest time from all LATAM countries (COPEC 2022), new legal frameworks which aim to create a more clinical trials friendly environment are being discussed. Additionally, Brazil has a competitive cost, reaching a fraction of 44% of the cost of clinical trials in other countries such as the USA (IQVIA data), which makes the country a potential future hotspot for clinical trials.

Interestingly, the majority of Brazilian companies still prioritize the domestic market, with Latin America (LATAM) or other international markets not being a focus for most of them. However, the local market heavily relies on imports. This could be due to the prevalence of a local-centric approach in domestic innovation strategies and efforts by technology transfer offices to prioritize local contracts and commercialization paths.

Considering the entire landscape, a strategy adopted by LATAM's VC firms, such as GRIDX, which holds the largest biotech portfolio in LATAM (66 companies) and is entering the Brazilian biotech investment market, is to internationalize the companies they invest in. This strategy aims to enhance success opportunities by accessing more mature markets.

At GRIDX, we see a big opportunity in Brazil; we see a high quality and quantity of scientists conducting cutting-edge science and increasingly seeking to enter the market in various ways. We believe that venture capital is a tool that fits very well with the needs of scientific developments and can help bridge the gap between what is produced in the laboratory and what reaches the market, in less time. At the same time, we also see that for these new companies to have a greater chance of success in this venture capital journey, they need a specific design. We aim to catalyze and accompany both scientists and business entrepreneurs.

- Francisco Javier Salvatelli, Brazil Manager at GRIDX, on his perspective of Brazilian VC investment activity

The Importance of a Diversity of VC firms in Biotech

Numerous studies consistently highlight the positive impact of venture capital on various aspects of company performance (refer to "Buy Local? The Geography of Successful and Unsuccessful Venture Capital Expansion," HBS, 2009). It has been shown that VC-backed firms generally outperform those without VC backing (Alperovych and Hubner, 2013; Bertoni et al., 2011; Croce et al., 2013; Engel, 2002; Zacharakis and Meyer, 1998). According to the literature, venture-backed companies tend to excel in operational growth, post-IPO performance, innovation, patenting activity, and scalability compared to their counterparts. Furthermore, while grants are crucial for advancing technology readiness levels, studies suggest that venture capital firms also play a vital role in nurturing entrepreneurial communities, leading to increased patents, new business creation, and revenue.

Despite its limitations, Brazil has outstanding research centers and principal investigators. The data on Brazilian biotech-venture backed companies also shows that the country is becoming a more biotech investing-friendly country. With the emergence of biotech-focused VCs we might see more investments in Brazilian biotech companies with internationalization strategies in the future.

The lead author of this article is Romina Horianski, PhD Candidate at the University of Sao Paulo - Brazil, Innovation Analyst at InovaHC - Brazil, LATAM Leader at Nucleate’s Ecosystems Research Initiative.

| Hidden Layers Lead |

Lauren Stanwicks

|

| Main Author |

Romina Horianski

|

| Hidden Layers Team |

Romina Horianski

Anisha Sharma

Lindsey Florek

|

| Graphic Design |

Marley Rossa

|