Highlights:

- 16% of venture capital firms based in Chicago focus on investing in biotechnology companies. 24% of these firms focus exclusively on biotech.

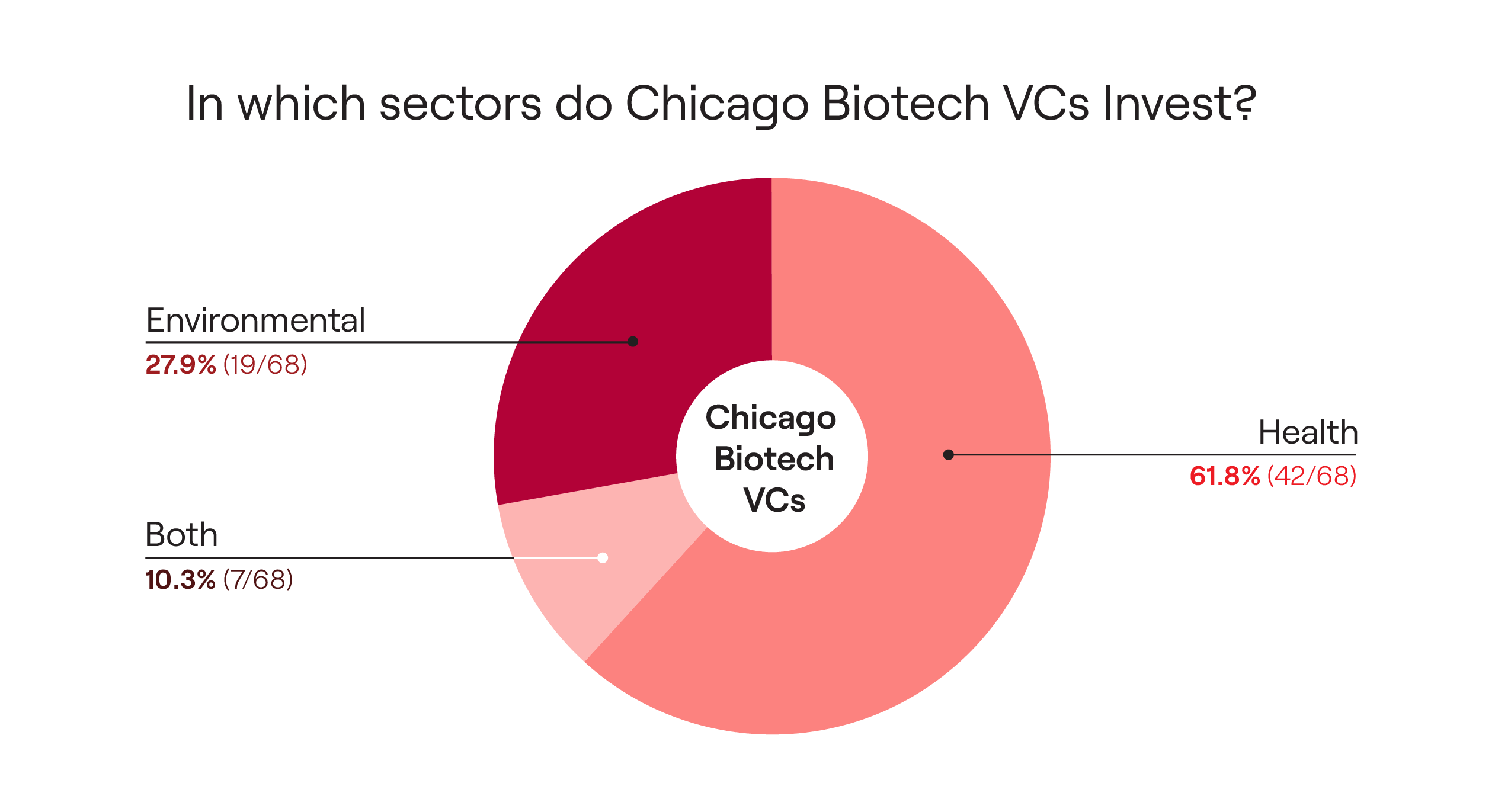

- The majority of the biotech investors in Chicago have a focus on health: 62% invest in health-related startups.

- 28% of Chicago biotech VC firms are focused on environmental investments, with 63% of these investing in food-related startups like alternative meats and proteins.

- 88% of biotech investors in Chicago prefer early-stage companies.

Chicago is a thriving hub for startups and venture capital, boasting over 400 venture capital firms and a wealth of incubator and accelerator programs. With top-ranked research institutions like Northwestern University, the University of Chicago, Loyola University Chicago, and the University of Illinois Chicago, the city nurtures talent and entrepreneurial aspirations, providing extensive support for both new and established entrepreneurs. This report highlights the leading biotechnology venture capitalists in the Chicagoland area and provides an overview of its biotech investment landscape.

Home to prominent companies like Abbvie, Baxter, and Astellas Pharma, Chicago stands out as a thriving center for biotechnology. To delve deeper into the city's biotech culture, we interviewed Michael Schultz, Director of Venture Operations at Portal Innovations, a biotech venture capital firm headquartered in Chicago. He notes that Chicago has "companies doing everything, but if there’s one area Chicago has more than the national average, it's in the intersection of chemistry and biology.” So then, it is not surprising that out of a total of 415 VC firms located in the greater Chicago area, 68 focus on biotech investments. Of these,16 firms exclusively invest in biotechnology.

To contextualize Chicago’s VC landscape, we utilized Crunchbase to find VC firm data. Within the biotech VC space, we classified firms on the basis of being geared towards companies that focus on “health” (medical and pharmaceutical technologies) versus environmental solutions-oriented technologies. Among these firms, 42 are health-focused, 19 are environmental-focused, and 7 support both. Industry-agnostic firms are not included in this analysis.

Among health-focused biotech VCs, the top three firms by total number of investments are:

- ARCH Venture Partners (484 investments)

- Specializes in the life and physical sciences and aims to connect industry partners with innovative labs.

- The Blue Venture Fund (98 investments)

- Collaboration between Blue Cross Blue Shield, the Blue Cross Blue Shield Association, and Sandbox.

- Invests in startups working on healthcare technology and in the clinical sciences.

- Abbvie Biotech Ventures (51 investments)

- AbbVie’s corresponding venture capital firm.

- Invests in technology related to neurology, oncology, immunology, aesthetics, and eye care.

- Make 6-8 new investments each year in Seed or Series A stages.

We also examined investors with a focus on environmental-related companies. The top three environmental-focused VCs include:

- S2G Ventures (158 investments)

- Invests in startups targeting issues in the agriculture, food, clean energy, and oceans sectors.

- Within the food sector, S2G Ventures specializes in food production, supply chain, and consumption companies.

- Cleveland Avenue (135 investments)

- Invests in restaurant, food tech, and beverage companies such as big name brands like Beyond Meat.

- Cultivian Sandbox Ventures (41 investments)

- Invests in startups in the food and agriculture industries, focusing on everything between sustainable and/or healthy food production and supply chain technology.

These top three environmental-focused VCs prioritize investments in food-based companies. In fact, a majority (63%) of environmental investors focus on food and beverage innovation, with many targeting companies that develop alternative meats and proteins as well as new agricultural technologies.

Additional notable VC firms that invest in both health and environmental related companies are Sandbox Industries (92 investments) and Impact Engine (84 investments). The former focuses on businesses in the food and agriculture, insurance, and healthcare markets. The latter invests in the economic opportunity, environmental sustainability, and health equity sectors.

Chicago’s biotech VC community is vibrant, with a strong emphasis on early-stage investments, followed by seed and late-stage ventures. Of the 68 VC firms examined, 24 invest in seed companies, 43 invest in early stage companies, and 13 invest in late stage companies.

Schultz noted that the appearance of 'early stage' startups can vary by city. He says that in Chicago, Portal Innovations often encounters companies with highly developed science and a solid proof of concept. However, these teams are frequently composed of first-time founders with less experience. This contrasts with cities like Boston, where early stage companies often feature seasoned, impressive teams yet their scientific developments are typically at an earlier stage. This unique characteristic sets Chicago apart in the biotech startup ecosystem.

Chicago boasts a diverse array of biotech investment firms alongside abundant entrepreneurial resources, fostering a thriving ecosystem for health- and environmental-based ventures. Schultz emphasized that while “Chicago has VCs across the landscape” there is untapped potential in integrating these resources. He compares it to a beloved Chicago institution:

“all the raw ingredients are there, someone just needs to bake the pizza.”

This analogy encapsulates the mission of firms like Portal Innovations—to forge a more interconnected network that leverages the city’s abundant talent and expertise. The ongoing transformation of Chicago into a burgeoning biotech hub is exciting to witness.

The information in this report is based on data and trends from Crunchbase as of June 2024. Due to the dynamic nature of the biotech industry, some details may change following publication.

| Main Author |

Anisha Sharma

|

| Hidden Layers Lead |

Lauren Stanwicks

|

| Graphic Design |

Marley Rossa

|

| Hidden Layers Team |

Romina Horianski

Anisha Sharma

Lindsey Florek

Samantha Fabregat

Pranita Atri

Ivy Fernandes |