How local is your biotech capital?

Biotech may be global in ambition, but our analysis shows that ecosystems thrive when capital arrives and stays.

Key Findings:

- Local capital matters: While biotech is global, ecosystems with strong local investor engagement, like SF and Boston, build more resilient, self-sustaining growth engines.

- Investor behavior varies by city: Some cities deploy large amounts of capital but reinvest little of it locally (e.g., San Diego, London); others retain and recycle local funds more effectively (e.g., Beijing, Lagos).

- Capital retention and investor density are key metrics: The best positioned biotech hubs have both deep investor bases and high levels of local reinvestment.

- Geography shapes opportunity: Emerging hubs often rely heavily on external funding, but cultivating internal capital loops can accelerate long term innovation.

Written by Lauren Stanwicks & Pranita Atri

Biotech is often described as a global industry, but where capital comes from, and where it stays, can shape the trajectory of entire ecosystems. While world class ideas can emerge anywhere, the chances of those ideas turning into companies often depend on geography. A key question remains: does location determine opportunity?

Would a biotech investor in San Francisco rather invest down the street than somewhere across the world? And if local investors tend to stay local, does that make it harder for companies in smaller or emerging hubs to succeed? In other words, does geography gate access to growth?

Biotech investors play a role that extends far beyond writing checks. They are often mentors, board members, and connectors, helping early-stage companies navigate scientific, regulatory, and commercial challenges. Proximity matters: local investors can build trust, offer hands-on guidance, and become pillars of their regional ecosystems. By contrast, non-local investors do not have these advantages, and often participate later or less directly.

Over the years, researchers have explored a range of factors that influence venture capital decision making. Internal attributes such as a firm’s reputation, portfolio diversity, and sector preferences have long been recognized as key drivers, while external forces like market conditions and technology trends also shape how and where capital is deployed. Recent research adds that city-level factors such as financial markets, innovation hubs, and policy environments, play a powerful role in shaping intercity venture flows.

While past studies have examined what drives VC activity across sectors and firms, fewer have explored the geography of capital behavior, especially within biotech. To close that gap, here we track how capital moves, and stays, across global biotech ecosystems, uncovering the local dynamics behind worldwide trends.

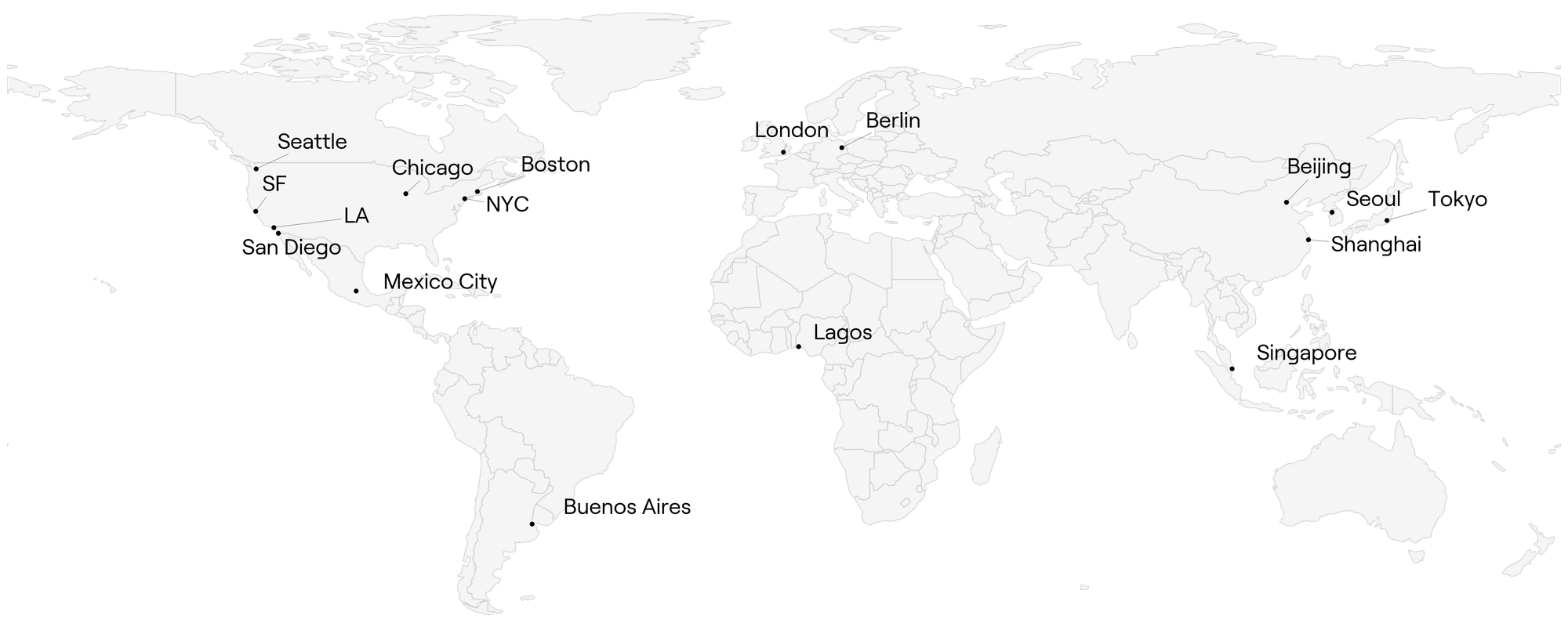

We analyzed Crunchbase data from 17 biotech hubs across North America, Europe, Asia, and Latin America, chosen for their prominence in deal flow and geographic diversity, to examine how capital moves in and out of ecosystems. Focusing on VC firms investing in Biotechnology, Health Care, and Science & Engineering sectors, we restricted our analysis to firms that invested in biotech startups, and to investment activity from the past five years. Using targeted search strategies (see Data Collection & Methodology following the article), we identified where VC firms are based, where they invest, and how much capital remains local.

This dataset allowed us to ask:

- How much biotech capital is sourced locally vs. externally?

- Which cities are anchored by loyal local investors?

- What makes a biotech ecosystem truly self-sustaining?

What emerges is a nuanced view of how capital flows, how committed investors are to their regions, and the powerful role geography continues to play in shaping biotech innovation.

Mapping Capital Flows and Investment Activity in Global Biotech Hubs

To gain deeper insights into the dynamics of these hubs, our initial step involved a comprehensive analysis of the total financial investment within these designated geographic areas. This analysis included a detailed categorization of both the entities providing the capital (the investors) and the capital itself (the investments). Specifically, we classified each investor and each instance of investment based on their geographical relationship to the specific city that constituted the innovation hub being studied. This local/non-local distinction allowed us to understand the degree to which these hubs were attracting capital from within their own regional economies versus drawing investment from external locations. This fundamental stratification formed the bedrock of our subsequent analyses aimed at unraveling the factors driving growth and sustainability within these critical innovation ecosystems.

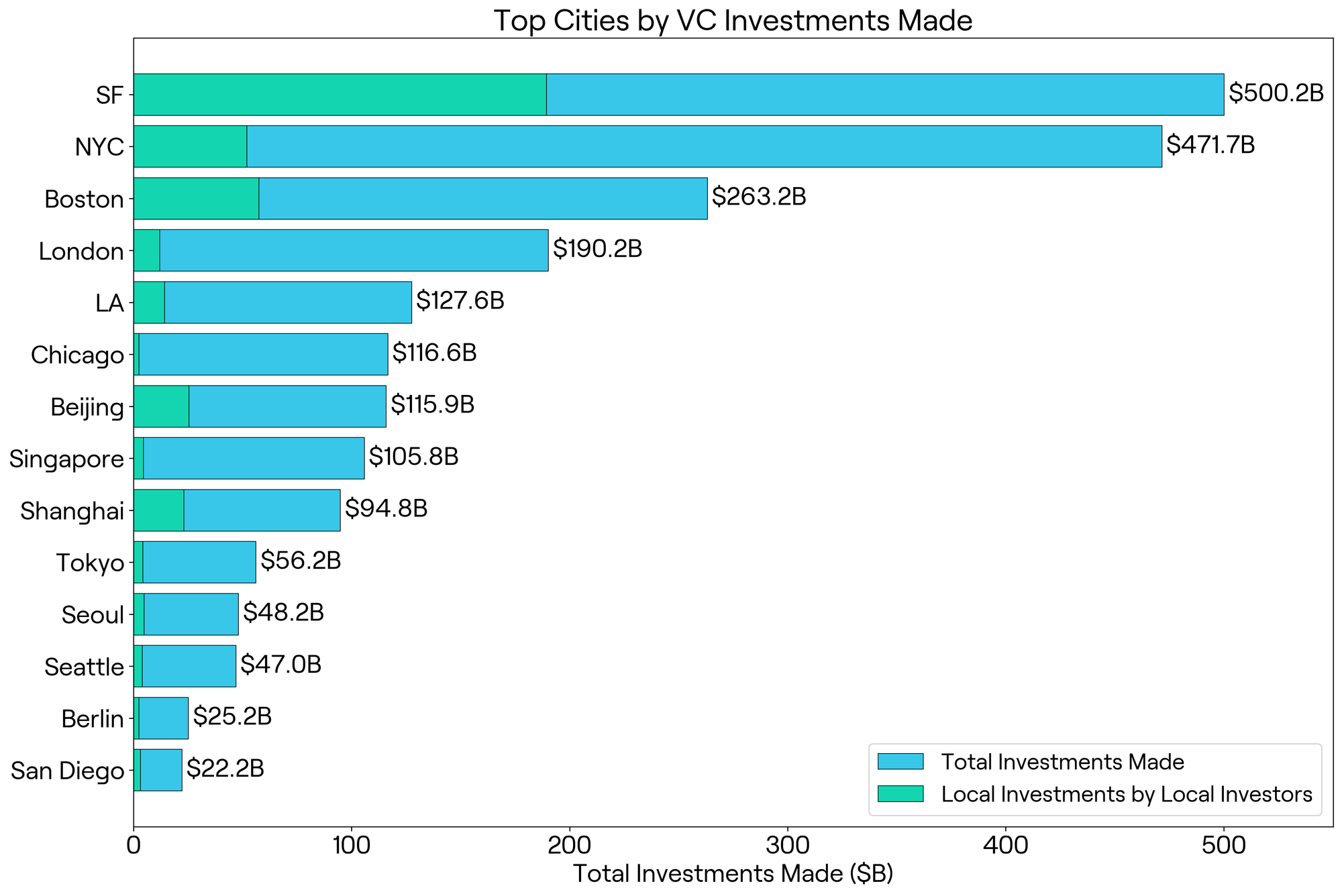

An in depth analysis of these investment trends reveals the continued dominance of San Francisco as the preeminent global hub for venture capital deployment in the biotech and biological sciences startup sectors. Data indicates that venture capital firms based in San Francisco have collectively invested over $500 billion into companies within these fields (Figure 1). Outside of the United States, London stands out as a significant hub with approximately $190 billion deployed, followed by Singapore and Beijing, contributing around $105 billion and $115 billion, respectively.

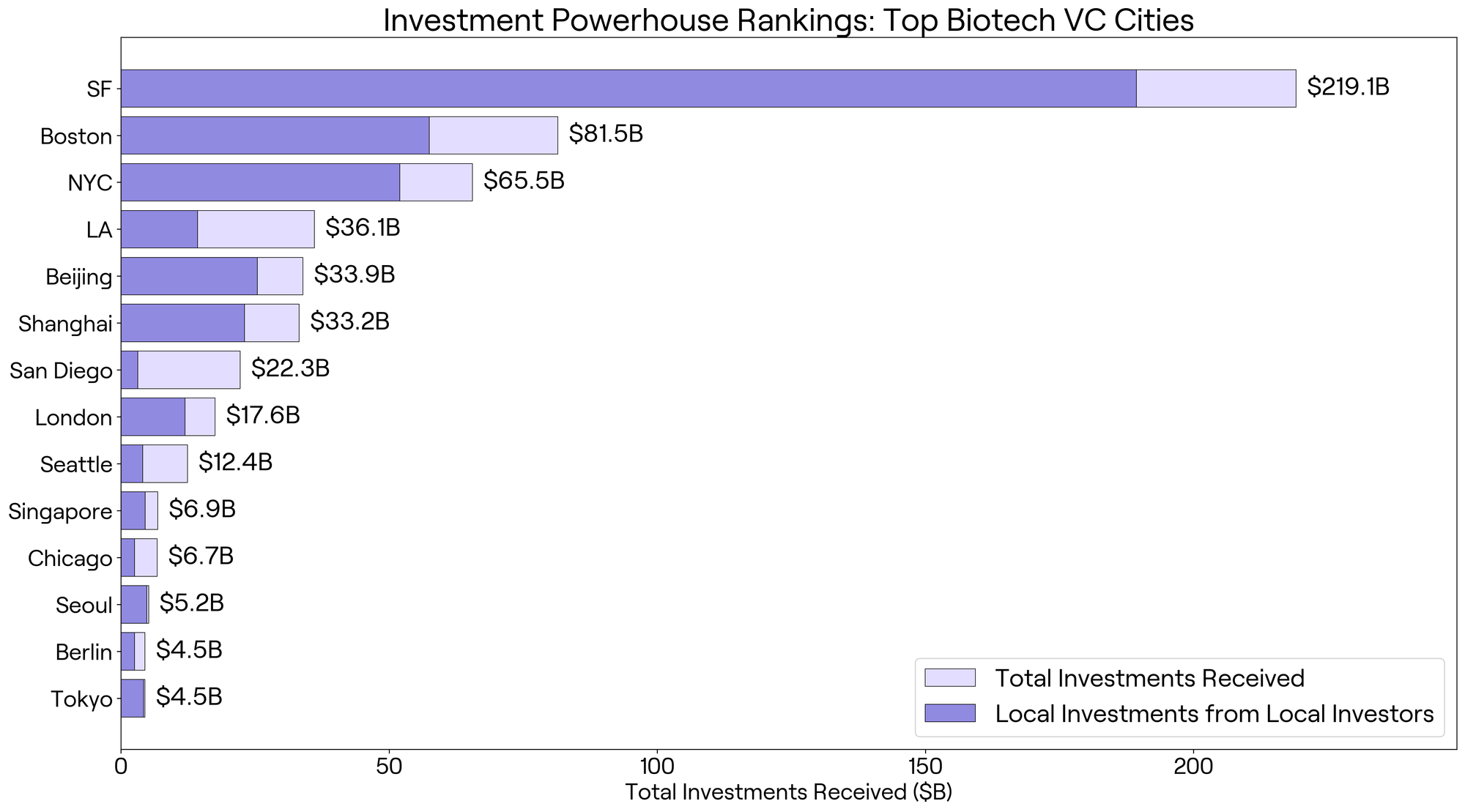

Examining the flow of capital with more granularity, a distinction emerges between the total capital received by startups in a particular city and the amount of venture capital originating from within that same city. Figure 2 illustrates these differences, comparing how much capital was received in each hub versus how much of that capital came from local investors. While major investor cities like San Francisco, New York City, and Boston attract substantial overall funding, a considerable proportion of their local VC capital is deployed in startups outside their home regions, suggesting a willingness to invest beyond geographic boundaries.

In contrast, cities such as Shanghai and Beijing exhibit a higher degree of local capital retention, meaning a larger percentage of the venture capital originating from these cities is invested in startups based within their own municipal boundaries. This could reflect a strategic focus on fostering local innovation ecosystems or potentially different investment philosophies.

Furthermore, certain emerging biotech and science hubs, such as San Diego and Mexico City, demonstrate limited local investor participation. Startups in these regions are significantly reliant on external funding sources to fuel their growth and development, highlighting potential opportunities for cultivating local investment capacity. These observations underscore the complex interplay of local and non-local investment in driving innovation and growth within the biotech and science sectors globally.

Local Loyalty: Are Local Investors Investing at Home?

After examining where biotech capital originates and where it ends up, we turned to a second question: are local investors supporting startups in their own cities? To answer this, we analyzed the share of investors based in a given city who had made at least one investment in a local startup. This metric reflects investor loyalty and serves as a powerful proxy for how embedded and engaged those investors are in their regional ecosystems.

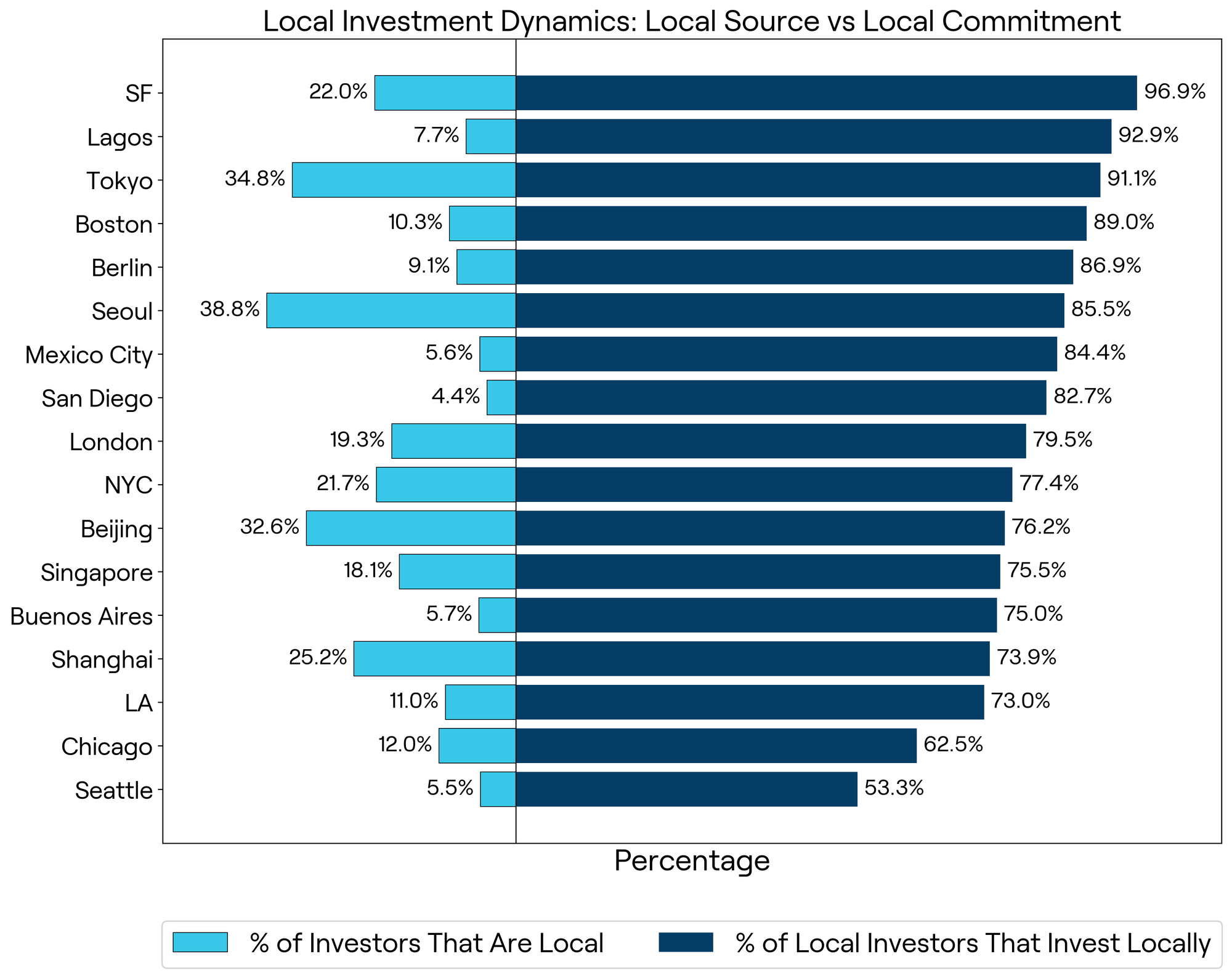

As shown in Figure 3, the results reveal striking variation across cities. San Francisco leads by a wide margin: 96.9% of its local investors have backed Bay Area startups, signaling a deeply rooted internal capital engine supported by dense networks and deal flow. Other cities show similarly strong local commitment. Lagos (92.9%), Tokyo (91.1%), and Boston (89.0%) all demonstrate high investor engagement within their ecosystems. Despite differences in size, stage, or geography, these hubs share a common strength: local investors who actively reinvest in local innovation. However, the pattern is far from uniform. In Chicago (62.5%) and Seattle (53.3%), the majority of local investors direct their capital elsewhere. The reasons for this disparity may include investor preferences for other sectors, smaller fund sizes, or lower perceived local deal quality. Whatever the cause, the implications are significant. Cities with lower local investor participation may find it harder to retain startups, guide early-stage growth, or build long term resilience.

Where biotech capital comes from matters, but so do the people who control it and whether they choose to reinvest it in their own community. Figure 3 visualizes these dynamics, offering a window into which cities are building from within, and which may still be reliant on outside forces to sustain their biotech future.

Written By Shivaranjani Balamurugan

San Diego offers a paradox: despite receiving over $22 billion in venture capital over the past five years, only 14.1% of its capital received comes from local investors. What explains this gap?

Several factors may be at play. San Diego investors often favor mature businesses over early-stage biotech, which they may perceive as too risky, capital-intensive, or long-term. Others prioritize later-stage deals or biotech sectors not well represented in the region (Business San Diego, 2023). Compounding this, many startups in San Diego are internationally connected through academic, licensing, or commercial partnerships, leading them to attract and cultivate non-local investors instead (fDi Intelligence, 2003).

A similar pattern appears in Buenos Aires, where only 5.7% of biotech investors are locally based. But the drivers are distinct. Argentina’s persistent macroeconomic instability, lack of robust startup financing infrastructure (e.g., bank loans), and limited domestic capital pools make local venture investment less feasible (Chambers and Partners, 2025). Foreign investors are more willing to step in, especially when currency arbitrage and lower operating costs promise attractive returns. Additionally, the region’s research-to-commercialization pipeline is often underfunded, requiring larger checks from international firms to advance products through clinical trials and regulatory hurdles.

These contrasting cases, San Diego’s capital conservatism and Buenos Aires’ economic constraints, highlight that low local investor engagement can stem from very different ecosystem dynamics. Yet in both cities, the outcome is the same: biotech startups rely heavily on capital from elsewhere.

The Roots of Biotech Resilience

A mature biotech ecosystem doesn’t just attract capital; it’s shaped by who provides that capital and where it stays. This section explores two structural features that signal ecosystem strength: investor density and capital retention.

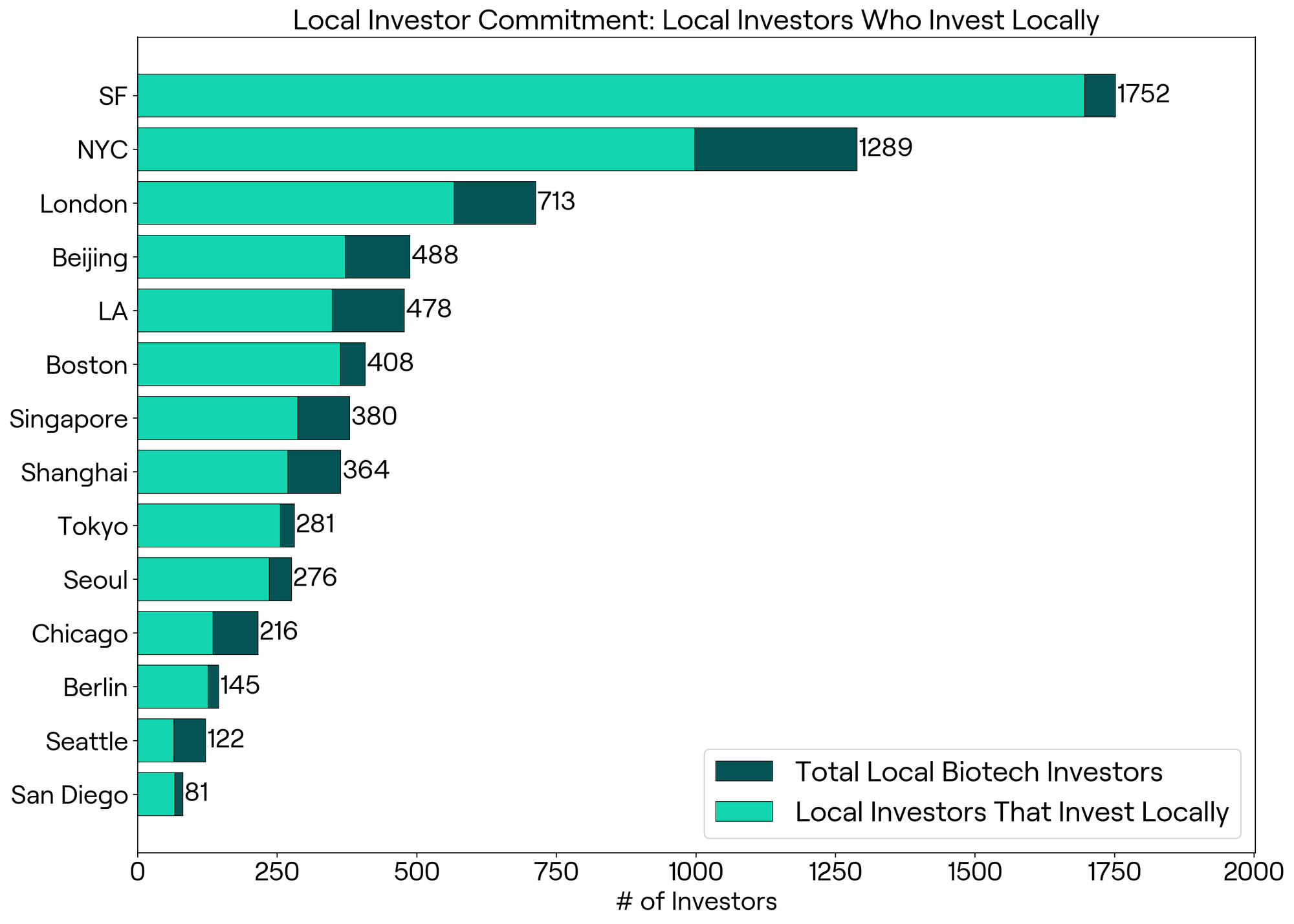

Investor Density reflects the volume of local investors embedded in a region. Cities like San Francisco, NYC, and London host large numbers of biotech investors, creating deep networks for mentorship, early-stage risk capital, and repeat deal flow. Figure 4 shows the raw number of local biotech investors by city, along with how many reinvest in their ecosystems. San Francisco leads by a wide margin with over 1,750 local biotech investors, followed by NYC and London.

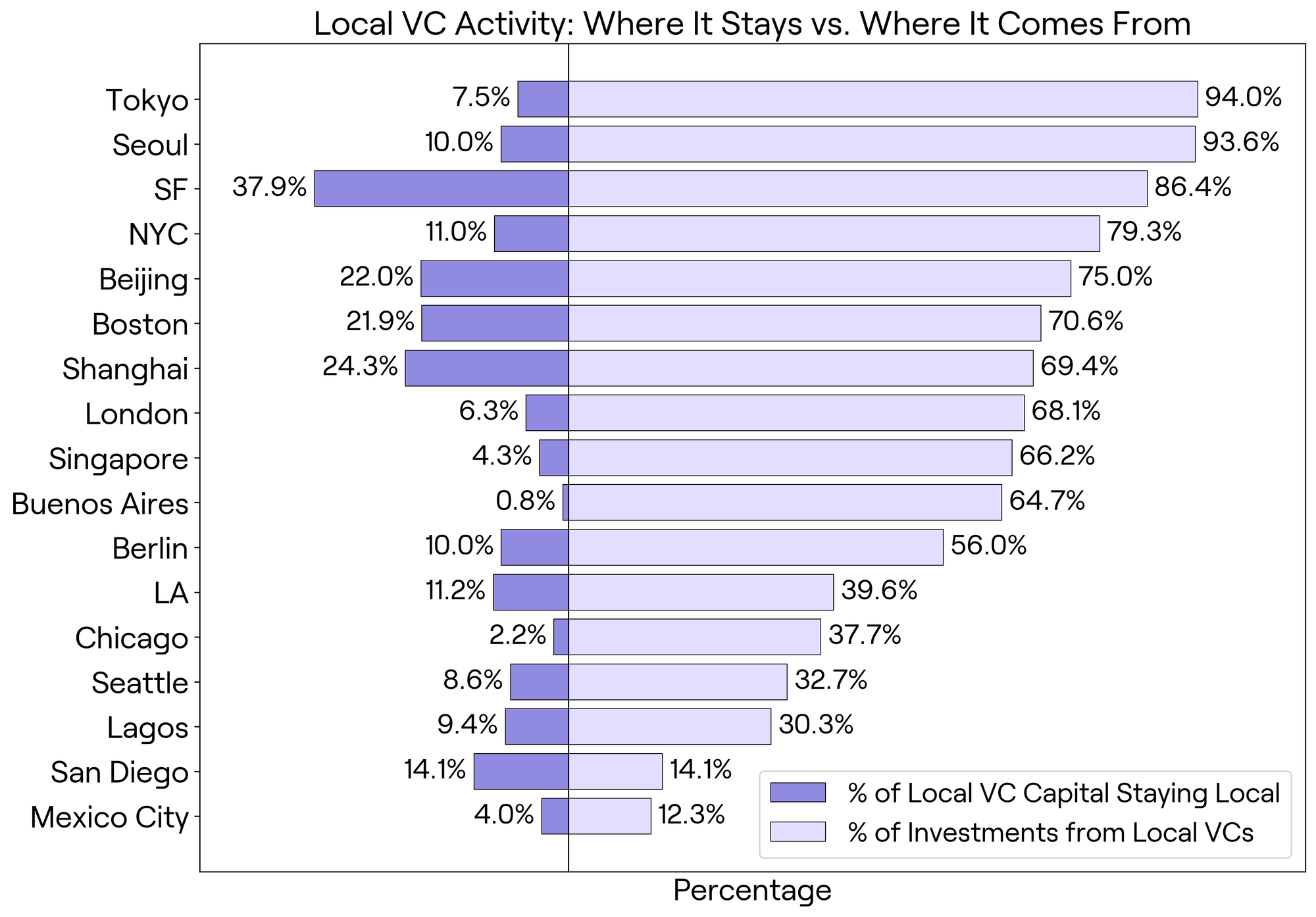

Capital Retention captures the stickiness of local capital: how much of investor-deployed capital is reinvested back into local companies. In some cities, local investors actively support their biotech communities. In others, local capital tends to flow elsewhere. Figure 5 contrasts these two dynamics: the percentage of local capital that stays local, and the share of total investments that come from local VCs. San Francisco and Boston stand out for their strong retention and sourcing of local capital, while cities like London, Singapore, and Mexico City export a significant share of their local funding.

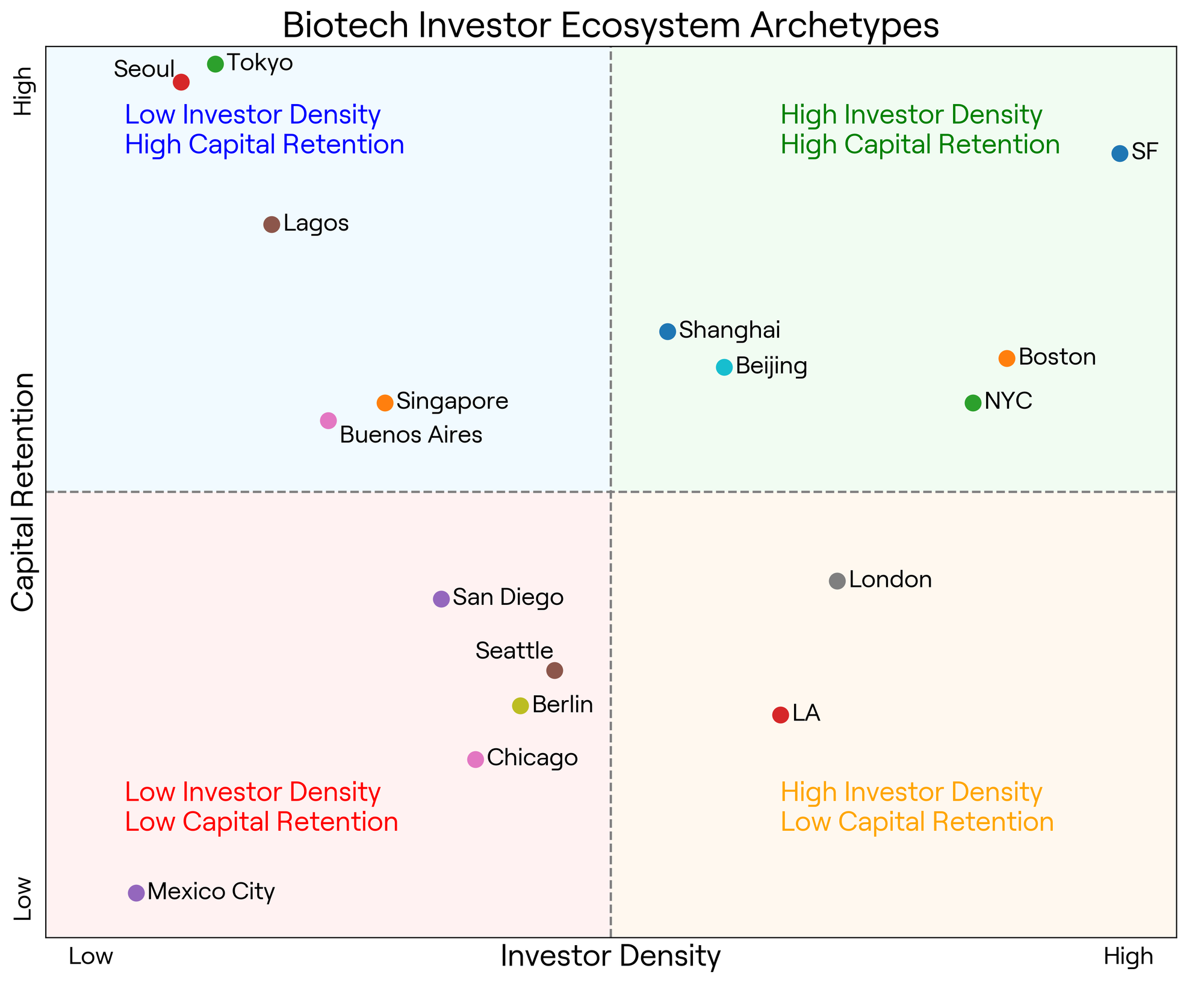

To better understand how these two dimensions interact, we categorized ecosystems into four Biotech Investor Archetypes (Figure 6). Cities in the top right quadrant, like San Francisco, Boston, and Beijing, combine high investor density with high capital retention, forming resilient internal funding engines. In contrast, London and New York fall into the “High Density, Low Retention” category: hubs with substantial investor presence but lower local commitment, indicating a tendency to export capital.

The upper left quadrant features cities like Tokyo, Seoul, and Lagos, which show strong investor loyalty despite smaller local VC communities: early ecosystems with promising internal engagement. Meanwhile, cities like San Diego, Mexico City, and Seattle fall into the “Low Density, Low Retention” category, revealing both a limited investor base and lower levels of local reinvestment.

To synthesize these dynamics into a unified benchmark, we created the Biotech Capital Self-Reliance Score (Figure 7). This composite metric averages three normalized indicators:

- The percentage of local VC capital that stays in-region

- The share of biotech investors based in the city

- The percentage of those investors who reinvest locally

Cities with high scores, such as San Francisco and Boston, show strong internal capital engines and investor loyalty: hallmarks of resilient, self-sustaining biotech hubs. When both investor density and capital retention align, ecosystems benefit from durable internal capital loops. Others, like Lagos and Tokyo, show signs of rising resilience, even with fewer investor resources. In contrast, cities like Mexico City or San Diego may attract significant external capital but lack the internal reinvestment necessary to support long-term growth.

Together, these indicators offer a framework for assessing ecosystem maturity. Cities that score high across all dimensions are better positioned to weather funding cycles and support innovation from within. Others may be on the rise, but will need to cultivate deeper investor roots to truly thrive.

From Capital to Commitment

Biotech may attract global capital, but it grows locally. This analysis reveals stark variation in how investors engage with their home ecosystems; from deeply embedded, self-sustaining networks like San Francisco and Boston, to undercapitalized hubs like San Diego and Mexico City that depend heavily on external funding.

For founders: Know your city’s capital landscape. A strong local investor base can provide more than just funding: it offers strategic alignment, faster decision making, and long term support.

For policymakers: Strengthen your region’s capital infrastructure. Tools like tax incentives, LP matching programs, and founder-investor networking initiatives can increase local reinvestment and ecosystem resilience.

For investors: Don’t overlook the underfunded. Cities like Lagos, Tokyo, and Buenos Aires have active startup communities but limited local backing, creating opportunities to lead early and shape the trajectory of emerging biotech hubs.

Local capital is not a silver bullet, but it’s a signal of system maturity. As the biotech sector continues to globalize, cities that invest in their own capital engines will be better equipped to withstand volatility, retain talent, and drive homegrown innovation.

Ultimately, the ecosystems best positioned to lead the next wave of biotech innovation will be those that are rooted, resilient, and built from within.

Hidden Layers Team

| Lead | Lauren Stanwicks |

| Team Members | Romina Horianski, Anisha Sharma, Pranita Atri, Lauren Clubb, Shivaranjani Balamurugan |

Data Collection & Methodology

We built a global dataset of biotech venture capital activity using Crunchbase’s Advanced Search tools, focusing on 17 leading biotech cities: San Francisco, NYC, Boston, LA, San Diego, Seattle, Chicago, London, Berlin, Buenos Aires, Mexico City, Lagos, Beijing, Shanghai, Tokyo, Seoul, and Singapore.

Our goal was to understand both the presence and behavior of VC firms. Specifically, how much biotech capital is deployed locally versus externally, and by whom. To do this, we conducted six Crunchbase searches, covering both investor-level and investment-level data. All searches were filtered to include only:

- VC firms (Investor Type = Venture Capital)

- Target sectors: Biotechnology, Health Care, and Science & Engineering

- Funding rounds announced since 2020 (for capital flow searches)

Investor-Level Searches (Advanced Search → Investors)

- VCs Based in a City: Identified venture firms headquartered in a given city that have backed biotech companies founded after 2010.

- VCs That Invest in a City: Found all VC firms, regardless of location, that had invested in biotech companies founded after 2010 based in the target city.

- Local VCs That Reinvest Locally: Intersected the above two searches to isolate local firms that also deploy capital locally, a measure of investor loyalty.

Investment-Level Searches (Advanced Search → Funding Rounds)

- Capital From Local VCs: Identified funding rounds led by investors headquartered in a given city, to understand how much capital local VCs deploy overall.

- Capital Into Local Companies: Captured all funding rounds raised by biotech companies in a given city, regardless of where the investor is based.

- Capital From Local VCs Into Local Companies: Intersected the above to track how much local capital stays local, our core measure of capital retention.

This dual-layered dataset enabled us to analyze investor density, local capital retention, and self-reliance across ecosystems, revealing where biotech is truly “built from within.” The information in this report is based on data and trends from Crunchbase as of June 2025. Due to the dynamic nature of the biotech industry, some details may change following publication.

References

- Du, D., Wang, J., & Li, J. (2024). What drives intercity venture capital investment? A comparative analysis between multiple linear regression and random forest. Humanities and Social Sciences Communications, 11, 1207. https://doi.org/10.1057/s41599-024-03695-x

- Business San Diego. (2023, July 24). Q2 VC report: $1.1 billion invested in San Diego. Medium. https://medium.com/@fredgrier/q2-vc-report-1-1-billon-invested-in-san-diego-2d6c2a00141d

- Chambers and Partners. (2025). Venture Capital 2025 – Argentina: Trends and Developments. Chambers.com. https://practiceguides.chambers.com/practice-guides/venture-capital-2025/argentina/trends-and-developments

- fDi Intelligence. (2003, April). Why San Diego? fDiIntelligence.com. https://www.fdiintelligence.com/content/bc7067d8-271a-5b69-8fba-48593e89069f

- Grier, F. (2023, November 28). Most active biotech investors in San Diego. Business San Diego. https://businessofsandiego.substack.com/p/most-active-biotech-investors-in