| Host |

Anastasia Janas

|

| Editors | Inakshi Chandra-Mohanty |

| Long-form writer | Alex Mandia |

| Social Media Managers | Priya Singhal Teresa Tenggono Jacquelyn Hilber Marina Khovedashian |

| Short-form Content Creator | Caitlin FitzMaurice |

| Listen | Apple Podcasts Spotify |

| Watch | YouTube |

Summary

In this episode of the Nucleate Podcast, Armon Sharei shares his journey from early life experiences in California, Iran, and Dubai to pursuing higher education at Stanford and MIT, ultimately leading to a career at the intersection of science and entrepreneurship. The conversation explores his motivations to make a positive impact on the world, the transition from academia to founding his first company Squeeze: a company based on innovative cell engineering technology and the challenges of navigating the biotech industry. Armon discusses the evolution of Squeeze from a platform to a therapeutics company, the difficulties of convincing investors and industry veterans, and the high-stakes decisions that shaped the company’s fate, including a major strategic pivot and the eventual fallout with the board. The episode also delves into personal and professional lessons learned, including the impact of a cancer diagnosis, the importance of safety and quality of life in drug development, and the value of mentorship and betting on talent. After Squeeze's liquidation, Armon founded Portal Biotechnologies, applying hard-earned lessons to focus on enabling broad innovation in cell therapy through platform technology. The discussion highlights the realities of biotech entrepreneurship, the significance of resilience, and the ongoing mission to empower others in the field, all while balancing personal passions and family life.

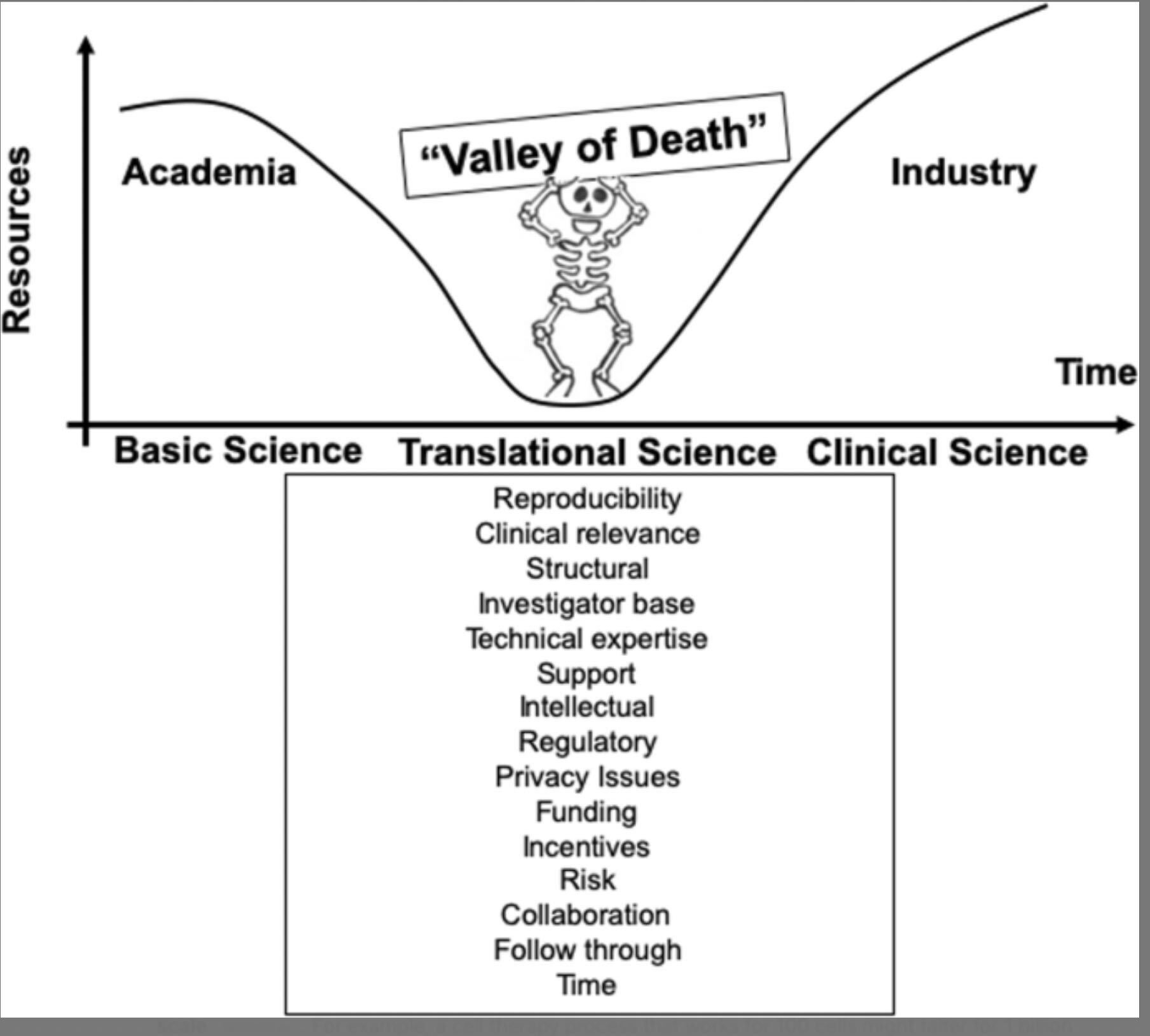

The valley of death or why biotechs fail

Motivated by the conversation with Armon Sharei, we kept circling back to a question that hangs over every startup founder: why do so many biotechs fail? Sharei’s own path illustrates the tension perfectly. Early on, he underestimated how brutally hard translation would be, assuming that strong academic science would naturally lead to adoption. Instead, he found himself battling skepticism, investor doubt, and the immense cost of proving credibility in a market where even the best ideas are questioned.

That same combination of grit and ambition—plus the painful lessons learned in failure—is what often separates biotech survivors from the graveyard. Founders often stumble because they underestimate how much their own psychology, team, and mission clarity shape every round, every pitch, every decision. And if failure is the default, then the only way to rise above it is to study it closely—so we can fail smarter, survive the winter, and eventually change medicine.

Excerpt from our latest blog post: Lessons From the Graveyard of Innovation

Walk through the archives of biotech press releases and you’ll see a familiar story. A bold new company, founded on dazzling science, flush with venture capital, led by pedigreed scientists and ex-pharma executives, promising to change medicine forever. Fast forward a few years and that same company has quietly folded, its website mothballed, its labs stripped for parts, its science forgotten.

Biotech is thrilling, but it’s brutal. By some estimates, 90% of biotech startups never deliver a marketed product. For every Moderna or Genentech, there are dozens of ventures that vanish without a trace. And the most dangerous threats aren’t always technical—they’re psychological. Sharei himself recalled that in the early days, investors dismissed his company as “kids with cartoons,” unwilling to believe in the vision until a pharma validation deal shifted the narrative. That gap between science and credibility is often where promising ventures go to die.

The field has matured enough that these types of patterns are visible in sharp relief. If you’re building, funding, or analyzing biotechs, the best way to tilt the odds in your favor is to study the companies that didn’t make it—and understand why.

Final Word

Biotech is unforgiving. The graveyard is filled with companies that had great science, great funding, great teams—yet still failed. But failure isn’t random. It clusters around predictable weak points: irreproducible science, platform vs. product confusion, capital missteps, scaling failures, poor management, regulatory shocks, and misaligned deals.

And this is where founder psychology matters. Biotech is not just science and capital—it’s storytelling under pressure. Sharei’s journey underscores this: early on, doubt and skepticism buried his first company, but persistence, reframing the narrative, and eventually validation from the right partners allowed him to push through in his next venture. Even setbacks became raw material for resilience.

In a field where failure is the default, that kind of growth mindset may be the real differentiator between the companies that end up in the graveyard, and those that survive long enough to change medicine.

The encouraging part? The ecosystem is learning. VCs now demand rigorous diligence, startups kill weak programs faster, regulators offer earlier guidance, and founders are more conscious of business-model fit.

Biotech will never be low-risk. But if failure is inevitable for most, the goal should be to fail smarter, fail faster, and fail cheaper—so that the survivors not only beat the odds, but truly change medicine. As Sharei put it on the podcast, founders need to think like cockroaches—hard to kill, resourceful, and always finding a way to survive even in hostile environments. In a biotech winter, that resilience isn’t just a metaphor; it’s a prerequisite.