Written by Liz Hughes, Gohta Aihara, Clara Brouaux, Kenza Mourji, Maggie Wang, & Lauren Stanwicks

About This Article

This article is part of Nucleate’s Global Life Sciences series and accompanies our recent event “Los Angeles × Paris: Life Sciences Across Continents”, which brought together leaders from two rising biotech ecosystems. Featuring insights from Dan Gober (Biocom California LA) and Estelle Botbol (Speedinvest), the conversation explored how both cities are tackling challenges in funding, infrastructure, and scientific innovation.

Drawing from this discussion and 10 years of venture capital data, the article provides a comparative look at the life science ecosystems of Los Angeles and Paris - highlighting their shared strengths, structural differences, and opportunities for transatlantic collaboration.

Watch the full event recording on YouTube: https://youtu.be/f7pdURuEjqg

From Paris to LA: Connecting Biotech Ecosystems

Comparative Context

Paris and Los Angeles (LA), while geographically distant, share surprising ties through institutional collaborations, academic exchanges, and a growing French presence in the LA innovation ecosystem. This article explores the synergies and differences between the two cities by analyzing venture capital (VC) funding trends to identify high-growth and innovation-driving sectors.

By focusing on funding patterns, we aim to better understand what’s fueling innovation in each city—from sector maturity to investment appetite and technological focus. These dynamics are reinforced by scientific diplomacy and transatlantic partnerships, such as the work of the Service pour la Science et la Technologie of the French Consulate in LA, which fosters collaboration between French and American institutions in biotech and life sciences (Consluat Général de France à Los Angeles).

Insights from the Global Life Sciences Series

On March 27th, Nucleate hosted an installment of its Global Life Sciences Series focused on the life science ecosystems of LA and Paris. With the insights from Dan Gober, Executive Director of Biocom California LA, and Estelle Botbol, Principal at SpeedInvest, the panel highlighted key parallels between these emerging life science hubs.

Both LA and Paris are cities on parallel trajectories in the life sciences sector, each benefiting from a deep well of academic talent fueled by major universities and research institutions. Additionally, both regions are anchored by large players in life sciences, such as Amgen in LA and Sanofi in Paris, that actively engage with local startups.

While capable of supporting both early-stage ventures and large pharmaceutical enterprises, both cities face challenges in retaining mid-sized companies. A central issue identified was the limited availability of mid-sized, independent lab space, which often drives growing startups to relocate to more established biotech hubs when scaling beyond traditional incubator facilities.

Despite these similarities, the fundraising landscape within LA and Paris differs significantly. In France, Estelle highlighted the role of a “young and dynamic” venture capital environment supported by robust government-backed, non-dilutive funding for life sciences startups.

In contrast, Dan noted that while LA “gets more grant funding from the federal government than anywhere else in the US” for research at the academic institutions, this funding tapers off as companies move off the academic campuses. Encouragingly, local efforts such as those led by the Department of Economic Opportunity are beginning to address this gap, advocating for expanded lab infrastructure to better support early-stage biotech companies.

Innovation Drivers: Sectors that Define Each City

Los Angeles thrives at the intersection of tech, media, and creativity. It leads in entertainment tech, AI, gaming, and space innovation, supported by a dense VC network of over 500 firms, numerous accelerators, and a top-tier talent pipeline from Caltech, USC, and UCLA. Major players like SpaceX, Northrop Grumman, and the Jet Propulsion Laboratory anchor a high-tech industrial base, while UCLA’s Innovation Fund and organizations like LACI (Los Angeles Cleantech Incubator) drive early-stage innovation.

While LA benefits from massive federal R&D grants, especially within academic institutions, early-stage private funding can be harder to access once companies spin out of academia. Furthermore, LA stands out for its diversity, with one in three residents foreign-born, and nearly 1.5 million residents hold degrees in science or engineering, fueling a cosmopolitan entrepreneurial spirit. From crypto to climate tech, and software to defense, Los Angeles blends scientific innovation with commercial scale, offering unparalleled market access and global reach for science-based startups (Startup Genome LA, 2023).

Paris leads Europe in deep tech, cleantech, and health innovation, backed by strong government support and public-private programs like French Tech Next40/120 and Tibi 2, a €7.6 billion initiative targeting decarbonization. The city is home to over 8,000 startups, more than 80 incubators, and at least 150 venture capital funds, forming a vibrant ecosystem for entrepreneurial growth. Paris is also home to the world’s largest startup campus, Station F, and the Paris-Saclay R&D cluster, which boasts the highest number of highly cited researchers globally.

The ecosystem is further strengthened by 21 elite business schools such as INSEAD and HEC Paris. France’s ambitious climate policies, including €54 billion allocated to green tech, and inclusive initiatives like the Paris-Saclay–Boston Women’s Entrepreneurship Class show the country’s long-term, impact-driven vision. From climate tech to quantum computing, fintech, and AI to life sciences, Paris' innovation economy reflects a deliberate policy push toward long-term, impact-driven sectors. In 2023 alone, French startups raised €8.3 billion, and Paris saw steady growth in Seed and Series A rounds, a testament to its evolving VC landscape. The city blends research excellence, public support, and entrepreneurial ambition (Startup Genome Paris, 2023).

Looking Ahead: What the Data Can Tell Us

To deepen this comparison, we analyzed ten years of venture capital data from Crunchbase (see Data Collection) to understand the underlying trends shaping each ecosystem. By mapping investment flows, early-stage funding dynamics, and sector-specific growth, this analysis provides a data-driven perspective on how LA and Paris are evolving as global innovation hubs and what their trajectories reveal about the next generation of science-driven ventures.

Funding Patterns: A Decade in Venture Data

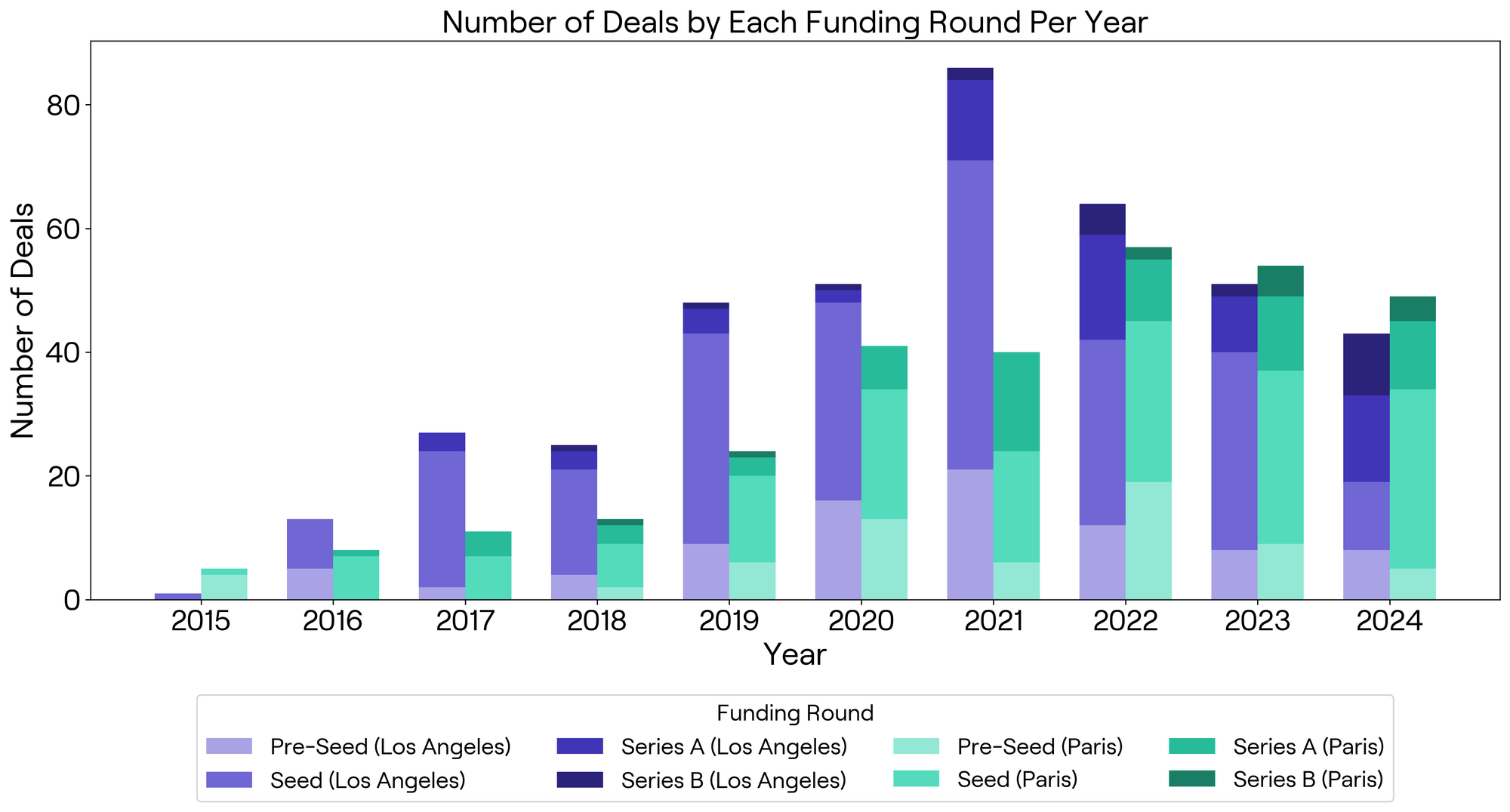

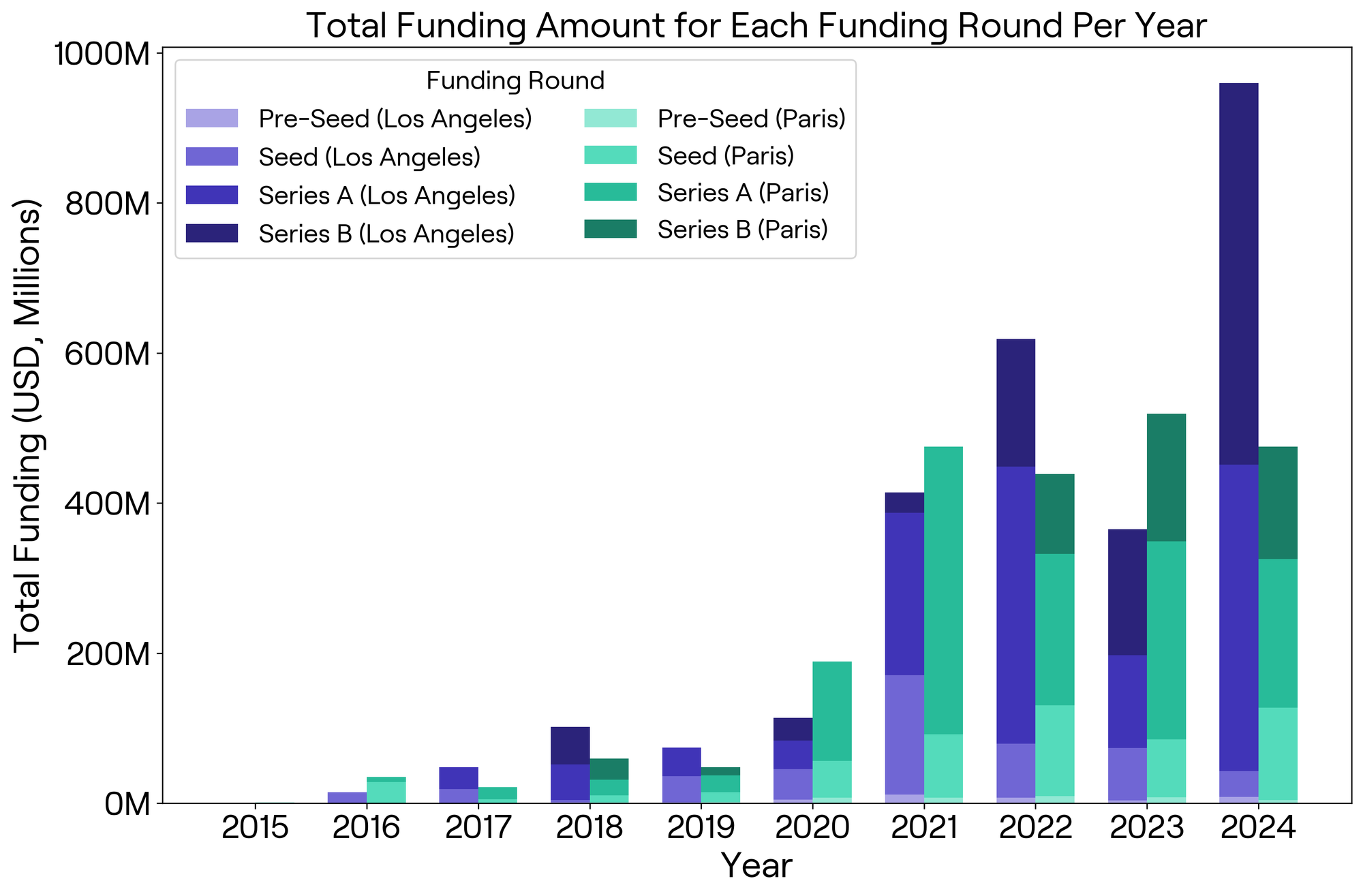

We first focused on the venture capital dynamics and strategies over the past decade by comparing the number of deals and total funding by each funding round per year (see data collection section).

Deal Volume Trends

From 2013 to 2022, LA consistently led Paris in number of deals. However, this trend reversed in 2023 and 2024, as Paris gained ground, indicating the recent growth of its biotech ecosystem (Figure 1). Interestingly, the distribution of funding rounds in LA shifted from pre-seed and seed-focused to a more balanced distribution, especially in 2024. This suggests that biotech investors in LA are most likely following the rounds of their existing investment. On the other hand, Paris shows drastic increases in the number of funding deals for pre-seed, seed, and series B companies in the past 5 years, which once again, indicates the overall growth of the ecosystem as well as the increasing tolerance for high risk startups.

Funding Amounts by Stage

When examining total funding by each funding round per year, LA and Paris demonstrate similar amounts of investments in biotech startups, despite more funding deals in LA between 2016 and 2022 (Figure 2). The difference in total funding across all funding rounds between LA and Paris was the highest in 2024, and drastically higher total funding in LA was driven by large Series B deals, highlighting the city's ability to attract substantial late-stage investments. It is interesting to note that while LA’s total funding fluctuates, Paris shows steadier growth, with a relatively even distribution across funding stages, demonstrating a more consistent investment strategy over the years.

Startup Maturation

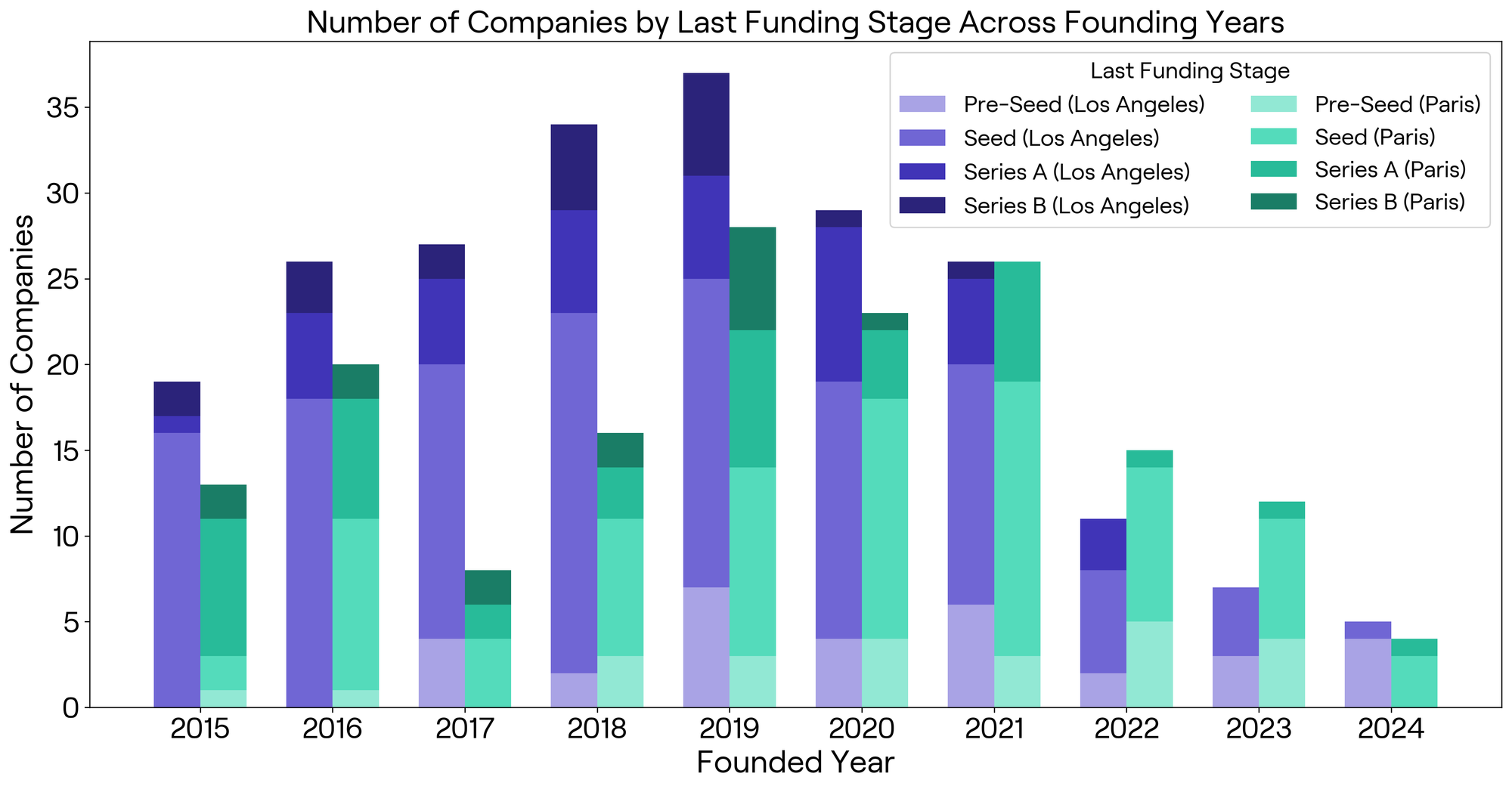

By tracking the last funding round reached by companies founded each year, we can assess how effectively each ecosystem matures its biotech startups (Figure 3). Both cities indicate that the number of companies founded each year was steadily increasing until 2019, though it fluctuates more in Paris. However, after the COVID-19 pandemic, fewer companies are being founded each year. Furthermore, both ecosystems are capable of successfully maturing their biotech startups, as many companies founded before 2020 have progressed to Series A, and Series B stages, especially the ones founded in Paris between 2015 and 2016.

From Seed to Scale: Early-Stage Ecosystem Dynamics

Los Angeles and Paris are vibrant hubs for early-stage startups, each with its own strengths. While both cities foster innovation, their ecosystems differ in funding patterns, support structures, and regulatory landscapes.

Funding Dynamics: Seed and Series A

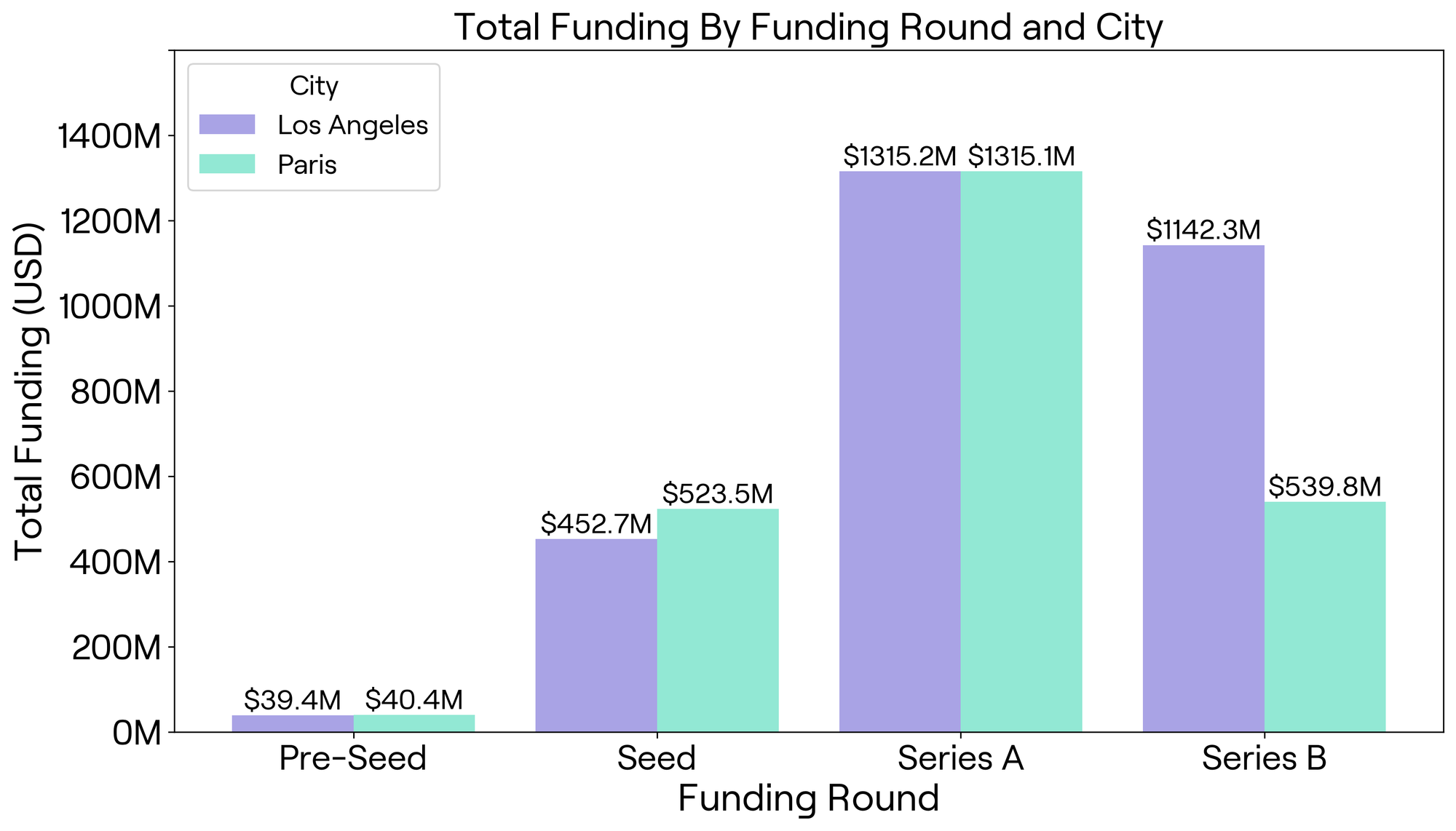

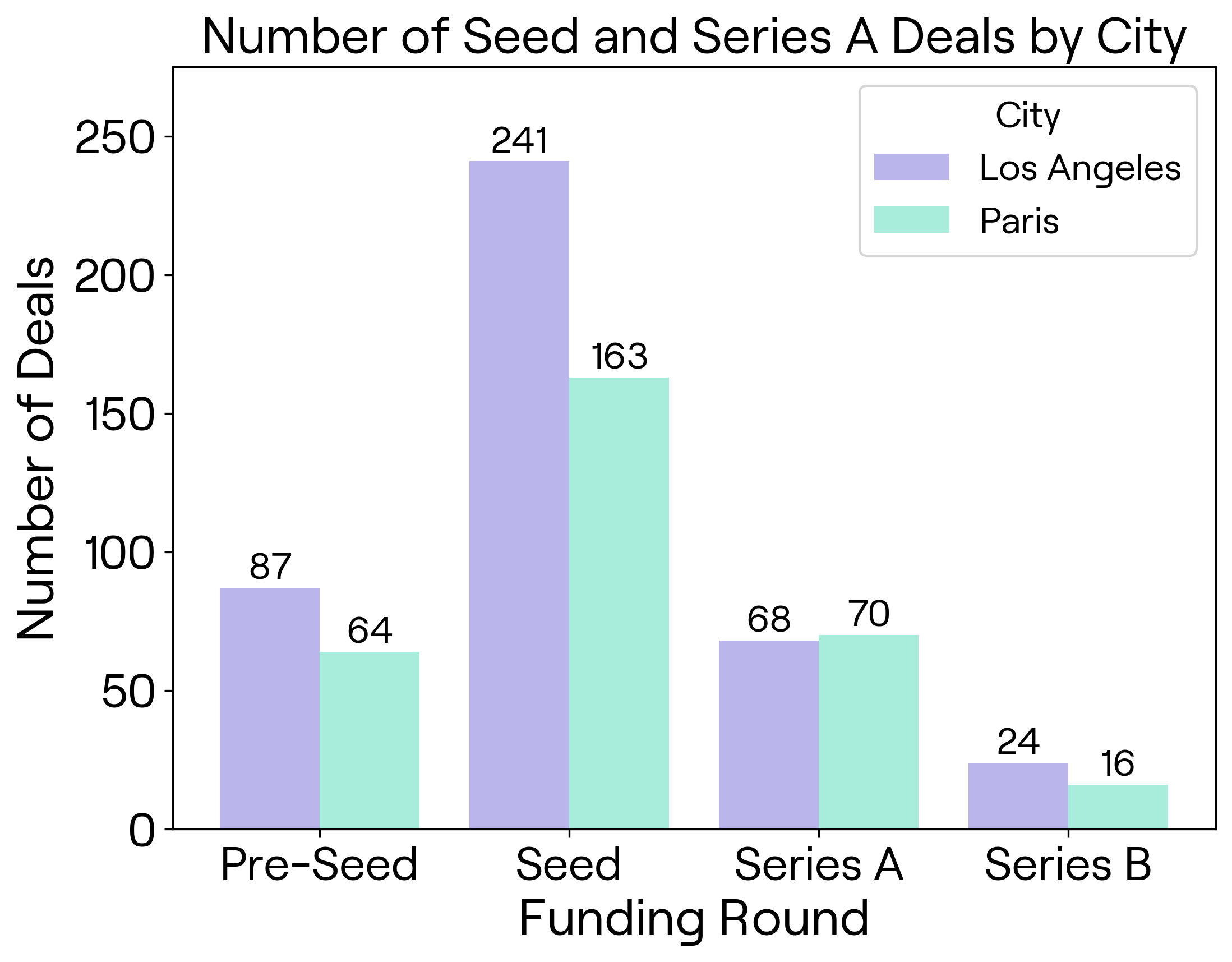

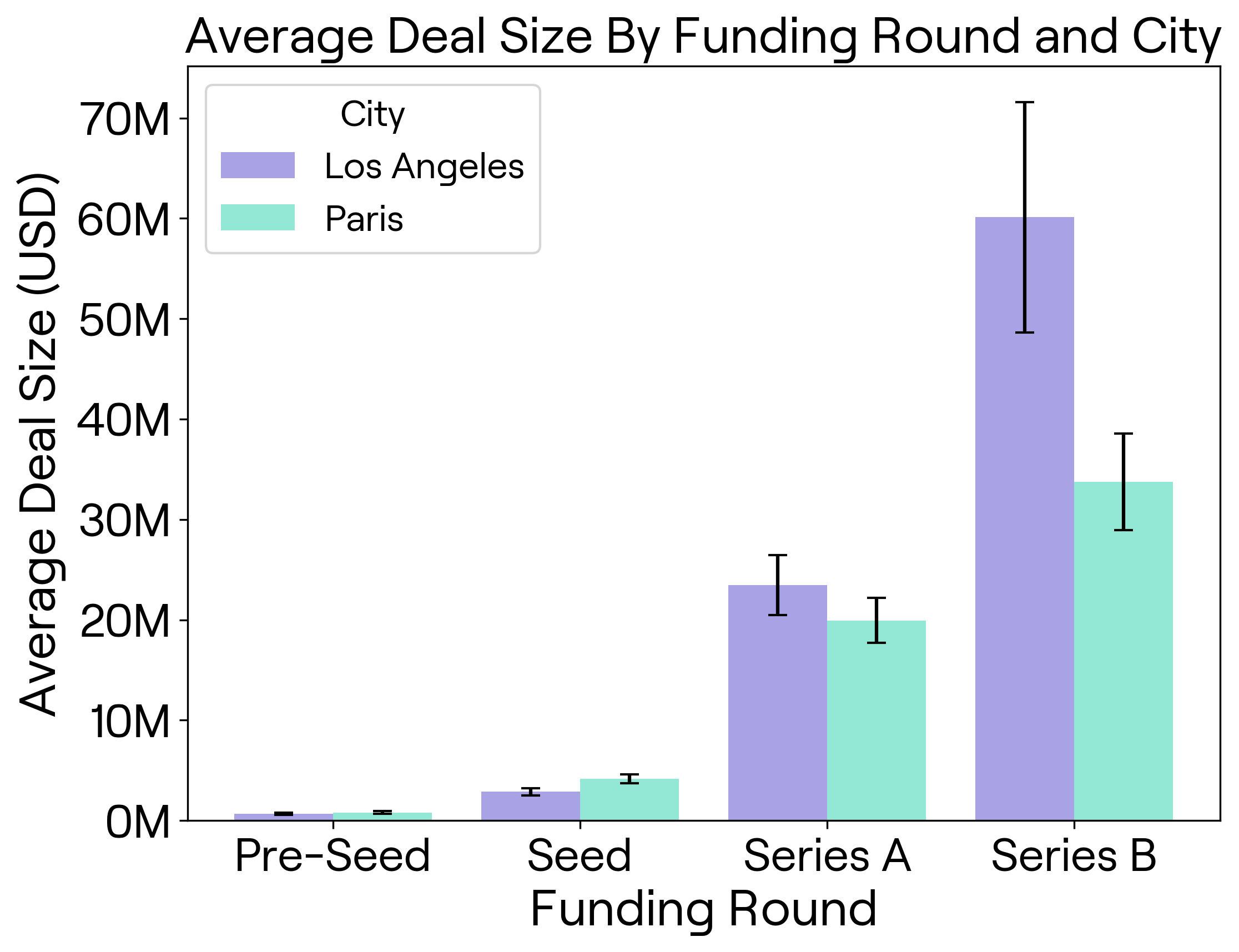

In Seed-stage funding, Paris slightly outpaces LA, with startups raising a total of $523.5 million compared to LA's $452.7 million (Figure 4). However, LA sees more Seed deals (241 vs. Paris's 163), suggesting a more distributed investment scene (Figure 5). In Paris, startups land larger Seed rounds, averaging $4.2 million per deal, nearly 45% higher than LA’s $2.9 million (Figure 4). This could point to Parisian investors betting bigger on fewer, high-potential ventures early on.

At the Series A level, total funding is nearly identical between the two cities, with LA startups raising $1.3152 billion and Paris startups close behind at $1.3151 billion (Figure 5). But LA startups pull in larger deals, averaging $23.5 million per deal, about 18% more than the $19.9 million seen in Paris (Figure 6). This shift may hint at a higher investor appetite for risk in Paris at the Seed level, while LA becomes more competitive at Series A, attracting larger investments from venture capitalists.

Series B and Beyond

What remains to be explored is whether startups in either ecosystem are more likely to graduate successfully to Series B and beyond. LA shows higher Series B deal counts (24 vs. Paris’ 16) and a higher average deal size ($60.1M vs. $33.7M), which could suggest better follow-up support or a more developed investor base ready to scale promising ventures (Figure 5 and 6). This trend may also reflect a broader dynamic: while Paris has built a strong early-stage pipeline, many startups with global ambitions still turn to the U.S. for later-stage funding where investor networks are deeper and capital more abundant.

Non-Dilutive Funding and TTO Support

Funding is critical, but a startup’s success also hinges on grants, regulatory ease, and access to innovation pipelines like technology transfer offices (TTOs). Paris shines here with robust government support. Programs like the French Tech Grant and French Tech Emergence Grant offer equity-free funding (from €30,000 to €2M), giving startups breathing room to experiment without diluting ownership (BpiFrance, European Commission, SharpSheets). The Crédit d’Impôt Recherche (CIR), a generous tax credit, can cover up to 30% of R&D costs, making Paris a haven for tech-driven ventures (Entreprendre.Service-Public.fr, SciencesPo). France’s centralized startup policies also streamline access to these resources (La Mission French Tech).

TTOs, which bridge academic research and commercial ventures, are another factor. In Paris, institutions like the Sorbonne, the Institut Pasteur, and INRIA have well-established TTOs that actively support spin-offs, though bureaucratic hurdles can sometimes slow the process (Sorbonne Université, Pasteur, INRIA). Still, the availability of grants and tax incentives often offsets these challenges, making Paris a compelling choice for founders in R&D-heavy fields like biotech or AI.

Los Angeles, by contrast, operates in a more fragmented but dynamic ecosystem. The U.S. Small Business Innovation Research (SBIR) grants provide non-dilutive funding, but they’re highly competitive, with success rates often below 15-20% (nsf.gov, ebhoward.com). They are also less suited for early-stage startups as they usually demand well-defined research plans and proof of technical or scientific innovation. Phase I grants, aimed at feasibility studies, typically range from $50,000 to $314,363 (as of October 2024). However, this may fall short for startups needing funds for broader needs like market validation or product development. Early-stage startups may lack these qualities, especially those in ideation phases. Phase II awards can reach up to $2,095,748, which are geared toward more advanced projects (sbir.gov).

The city’s strength lies in its vast network of angel investors and VCs, which fuels its high deal volume at the Seed stage. While universities like UCLA and USC play a key role in spinning out innovation, one of the main bottlenecks for early-stage biotech and deep tech startups in LA isn’t necessarily tech transfer; it’s the challenge of finding and affording lab space once ventures move beyond academia. This constraint can delay experimentation, increase burn rate, and limit the ability of promising startups to scale efficiently in their early stages.

Overall, both cities provide fertile ground for startups, but the choice between them may depend on the entrepreneurs’ specific needs and strategies.

What Gets Funded: Sectors that Define Paris and LA

While funding dynamics and support structures shape the startup journey, another key lens is the type of innovation each ecosystem fosters. The sectoral focus of startups provides insight into the economic and scientific priorities of each region. By looking at the most well-funded companies, we can begin to understand not only where capital is flowing, but also how each city positions itself in the global innovation landscape.

Los Angeles: Concentration in Therapeutics and Climate-Tech

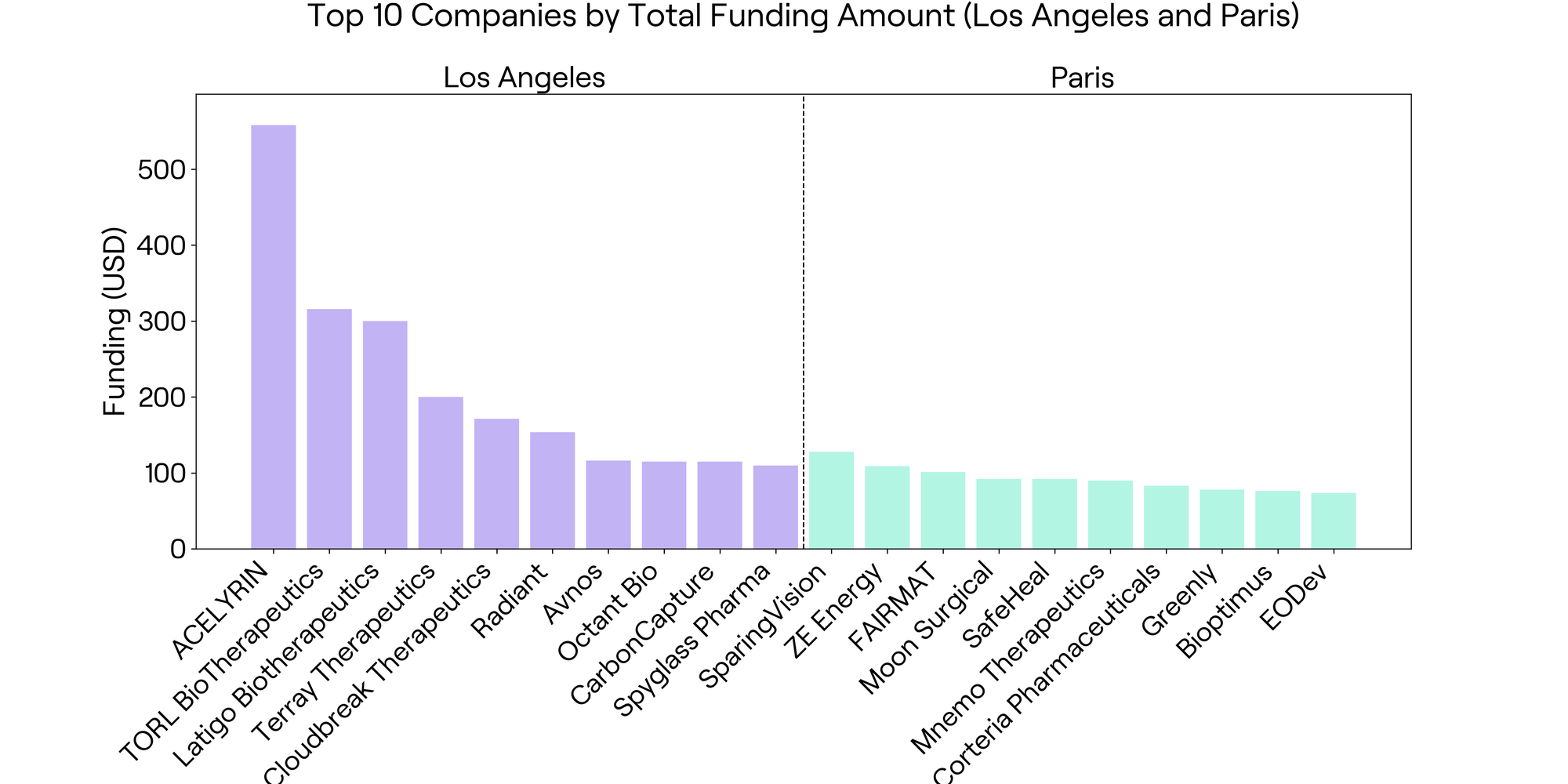

LA’s startup scene is heavily concentrated in therapeutics, particularly in immunology, oncology, and ophthalmology. Among the city’s ten most well-funded tech startups, seven are focused on developing novel therapeutics. This highlights LA’s role as a launchpad for translational medicine.

The most well-funded clinical-stage therapeutics company is ACELYRIN, with $558 million in funding. Its leading asset, Lonigutamab, targets the $2.1 billion thyroid eye disease market and is currently in Phase 2 clinical trials (Figure 7, Biospace). Other notable clinical-stage companies include TORL Biotherapeutics, Cloudbreak Therapeutics, and Spyglass Pharma, all of which have entered Phase 2, Phase 1 or early clinical trials (TORL Biotherapeutics, Cloudbreak therapeutics, Spyglass Pharma).

In the preclinical space, Latigo Biotherapeutics is working to develop safer, non-opioid pain therapies using insights from ion channel biology, backed by $300 million in funding (Latigo). Terray Therapeutics and Octant Bio represent LA’s pivot toward data-driven drug discovery, integrating AI and multiplexed assays to rapidly identify novel compounds (ZE Energy, FAIRMAT, Greenly).

Beyond biotech, a new generation of climate-tech startups is emerging in LA. Radiant is building compact nuclear microreactors to deliver clean, portable energy for remote and defense applications (Radiant). Avnos and CarbonCapture are tackling the climate crisis with innovative direct air capture (DAC) technologies, designed to remove CO₂ from the atmosphere more efficiently and at scale (Avnos, CarbonCapture). These startups are translating LA’s deep engineering and biotech expertise into climate solutions with global relevance.

Together, these companies reflect a region that excels not just at discovery, but at scaling innovation in both healthcare and climate resilience. With deep investor networks, access to top-tier research institutions, and a growing community of founders, LA continues to define itself as a hub for ambitious, high-impact science.

Paris: Diversified Across Biotech, Climate-Tech, and MedTech

While LA’s ecosystem is driven by clinical-stage therapeutics, Paris presents a more diversified landscape shaped by therapeutics, climate-tech, and medtech.

Paris also has a strong presence in therapeutics, with three of its ten most well-funded startups in this space. These companies target fields such as ophthalmology, oncology, and cardiovascular disease, similar to those emphasized in LA. However, most Paris-based therapeutics startups are still in the preclinical or early clinical stages. SparingVision, the most advanced among them, has completed a Phase I trial for its lead drug, SPVN06, and is preparing for Phase II (YSIOS Capital). This suggests that while the Paris therapeutics ecosystem is active and innovative, it remains earlier in its development lifecycle compared to LA.

On the other hand, Paris demonstrates stronger representation in climate-tech, with four top-funded startups spanning hardware, materials, and digital solutions. For example, ZE Energy builds hybrid photovoltaic power plants, FAIRMAT develops recycled carbon composite materials, and Greenly provides carbon accounting software for businesses (ZE Energy, FAIRMAT, Greenly).

Distinctively, Paris is also cultivating a vibrant medtech and AI sector that is largely absent in LA’s top funded startups. Moon Surgical develops robotic systems for minimally invasive procedures, while SafeHeal focuses on post-surgical protection devices (Moon surgical, SafeHeal). Bioptimus is building a foundational AI model for biology, branding itself as a “ChatGPT for life sciences” (Bioptimus).

Overall, many of LA’s top-funded startups are already advancing into clinical trials, reflecting the region’s strong foundation in translational medicine and deep ties to biotech innovation. Paris, by comparison, has a notable concentration of mission-driven climate tech and AI initiatives, aligning with a broader European embrace of the “impact startup” model. Each region showcases a distinct yet complementary approach to tackling global challenges through entrepreneurship.

Two Innovation Models, One Transatlantic Opportunity

The comparison between Los Angeles and Paris reveals two ecosystems with distinct strengths, funding structures, and innovation strategies. Los Angeles stands out for its strong foundation in clinical-stage therapeutics, backed by a broad network of VC firms and a steady stream of translational research emerging from academic institutions.

In contrast, Paris leans into a more concentrated, mission-driven model. While Parisian startups secure fewer early-stage deals overall, they raise significantly larger Seed rounds on average. This points to a strategy that favors higher-conviction bets on select companies. Robust public support, including equity-free grants, R&D tax credits, and nationally coordinated policies, helps reduce early-stage financial risk and allows founders to focus on longer-term, deep-tech innovation.

Differences in later-stage funding also stand out. Both cities raised nearly the same total amount at the Series A level, at around $1.315 billion. However, Los Angeles saw more Series B deals and a larger average deal size (Figure 5, Figure 6). This suggests stronger follow-on support in LA and a more developed late-stage investment base, allowing companies to scale beyond proof-of-concept more readily. Paris, by comparison, continues to excel in ideation and early technical validation, especially in fields like AI for biology and climate-tech.

Looking ahead, there are clear opportunities for collaboration. Paris-based startups could benefit from LA’s access to later-stage capital and clinical infrastructure. LA companies, in turn, may find strategic advantages in France’s grant-rich, policy-aligned ecosystem, particularly for projects in deep-tech and sustainability. As speakers at the Global Life Sciences Series noted, unlocking this potential may require addressing shared challenges, including the lack of mid-sized lab space and the difficulty of bridging academic research with commercial execution.

Ultimately, Los Angeles and Paris are evolving into complementary innovation hubs, shaped by fundamentally different models. Paris benefits from centralized, government-backed funding and national policy coordination. Los Angeles, by contrast, is driven by private capital and decentralized networks rooted in academia. These contrasting approaches offer valuable insights into how startup ecosystems can balance public support with private sector dynamism to foster life science innovation.

Methodology and Data Sources

We gathered all data for this report from Crunchbase on May 6th, 2025.Two separate databases were used: Funding Rounds and Companies. Filters were applied to extract relevant insights for both the Paris and Los Angeles ecosystems.

Funding Rounds Dataset

Used for Figures 1, 2, 4, 5, and 6

- Organization location: Ile-de-France, Paris or Greater LA area

- Organization industries: Biotechnology, Pharmaceuticals, Carbon Capture, Biopharma, Therapeutics, GreenTech, Medical Device, Genetics, Precision Medicine, Environmental Engineering, Alternative Protein, Health Diagnostics, Biometrics, Oncology, CleanTech, Life Science, Bioinformatics, Nanotechnology, Neuroscience, Renewable Energy, Biofuel, Pollution Control, Biomass Energy, AgTech

- Funded organizations, founded date: after 01/01/2025

- Funded organizations, operating status: active

- Funding status: Seed, Early Stage Venture

Companies Dataset

Used for Figures 3 and 7

- Headquarters location: Ile-de-France, Paris or Greater LA area

- Industries: Biotechnology, Pharmaceuticals, Carbon Capture, Biopharma, Therapeutics, GreenTech, Medical Device, Genetics, Precision Medicine, Environmental Engineering, Alternative Protein, Health Diagnostics, Biometrics, Oncology, CleanTech, Life Science, Bioinformatics, Nanotechnology, Neuroscience, Renewable Energy, Biofuel, Pollution Control, Biomass Energy, AgTech

- Number of employees: 1-10, 11-50, 51-100, 101-250

- Founded date: after 01/01/2025

- Operating status: active

- Last Funding Type: Pre-Seed, Seed, Series A, Series B, Series C

References

Institutional and Government Sources

- Consulat Général de France à Los Angeles. Service scientifique du consulat. https://losangeles.consulfrance.org/service-scientifique-du-consulat-de-los-angeles

- Bpifrance. Bourse French Tech. https://www.bpifrance.fr/catalogue-offres/bourse-french-tech

- European Commission. Youth Wiki: Start-up funding for young entrepreneurs. https://national-policies.eacea.ec.europa.eu/youthwiki/chapters/france/39-start-up-funding-for-young-entrepreneurs

- La Mission French Tech. French Tech 2030 Program. https://lafrenchtech.gouv.fr/fr/programme/french-tech-2030/

- French Government. Crédit d’Impôt Recherche (CIR). https://entreprendre.service-public.fr/vosdroits/F23533

- SciencesPo. The French policy mix and support for private R&D. https://www.ofce.sciences-po.fr/blog/the-french-policy-mix-and-support-for-private-rd-what-realities-for-what-results/

- NSF. SBIR/STTR Phase I Opportunities. https://www.nsf.gov/funding/opportunities/sbirsttr-phase-i-nsf-small-business-innovation-research-small-business

- SBIR.gov. About the SBIR Program. https://www.sbir.gov/about

- EBHoward Consulting. SBIR/STTR Success Rates. https://www.ebhoward.com/success-rates-of-the-national-science-foundations-sbir-sttr/

Academic and Research Institutions

- Sorbonne Université. Transfert de connaissances. https://www.sorbonne-universite.fr/recherche-1/innovation-et-valorisation/transfert-de-connaissances

- Institut Pasteur. Technology Transfer and Innovation. https://www.pasteur.fr/en/innovation/about-us/our-organization/technology-transfer

- INRIA. European TTO Circle. https://www.inria.fr/fr/european-tto-circle

Startup Ecosystem Reports

- Startup Genome. Los Angeles Ecosystem Report, 2023. https://startupgenome.com/ecosystems/los-angeles

- Startup Genome. Paris Ecosystem Report, 2023. https://startupgenome.com/ecosystems/paris

- SharpSheets. Top Public Grants for Startups in France. https://sharpsheets.io/blog/france-top-public-grants-startups/

Los Angeles-Based Startups:

- ACELYRIN. Market analysis on thyroid eye disease. BioSpace. https://www.biospace.com/thyroid-eye-disease-market-to-reach-usd-4-139-7-million-by-2034-impelled-by-orbital-electromyography

- TORL Biotherapeutics. https://torlbio.com/

- Cloudbreak Therapeutics. Leadership Team. https://cloudbreakpharma.com/about/#management

- Spyglass Pharma. https://www.spyglasspharma.com/

- Latigo Biotherapeutics. https://latigobio.com/

- Radiant Nuclear. https://www.radiantnuclear.com/

- Avnos. https://www.avnos.com/

- CarbonCapture Inc. https://www.carboncapture.com/

Paris-Based Startups:

- SparingVision. FDA Support for SPVN06 Phase II Trial. Ysios Capital. https://ysioscapital.com/2025/04/22/sparingvision-receives-fda-support-to-initiate-phase-ii-trial-of-spvn06-in-geographic-atrophy-secondary-to-dry-amd/

- ZE Energy. https://ze-energy.com/en/

- FAIRMAT. https://www.fairmat.tech/

- FAIRMAT – FairPly Materials. https://www.fairmat.tech/advanced-recycled-materials/fairply/

- Greenly. https://greenly.earth/en-us

- Moon Surgical. https://moonsurgical.com/

- SafeHeal. https://www.safeheal.com/

- Bioptimus. https://www.bioptimus.com/