About This Article

This article is part of Nucleate’s Inside Global Life Sciences series and accompanies our event “Denmark × Norway: Nordic Biotech Ecosystems”, which brought together leaders from two distinct but interconnected life science hubs. Featuring insights from Markus Herrgård (Bioinnovation Institute) and Andy Boyce (Centre for Digital Life Norway), the conversation explored how Denmark’s strong pharmaceutical foundation and Norway’s emerging eco-tech focus are shaping the Nordic innovation landscape.

Drawing from this discussion and ecosystem data, the article examines the unique drivers, sector strengths, and investment trends in each country, highlighting their potential for cross-border collaboration and sustainable biotech growth.

Watch the full event recording on YouTube: https://www.youtube.com/watch?v=Wjg03GnegcM&t=566s

Key Takeaways

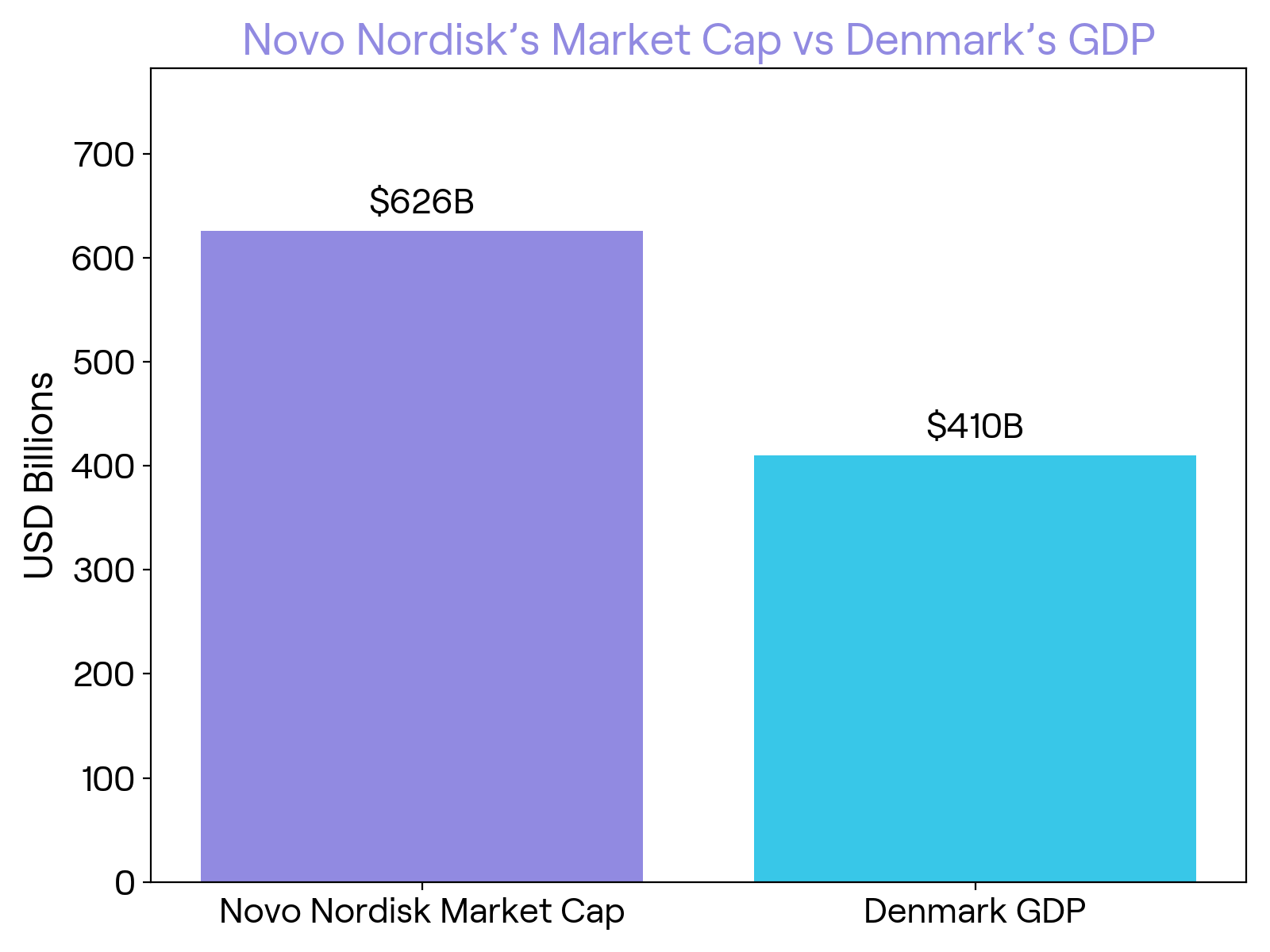

- Denmark’s biotech boom is driven by its pharmaceutical sector, with Novo Nordisk’s market cap now exceeding the country’s GDP (Figure 1).

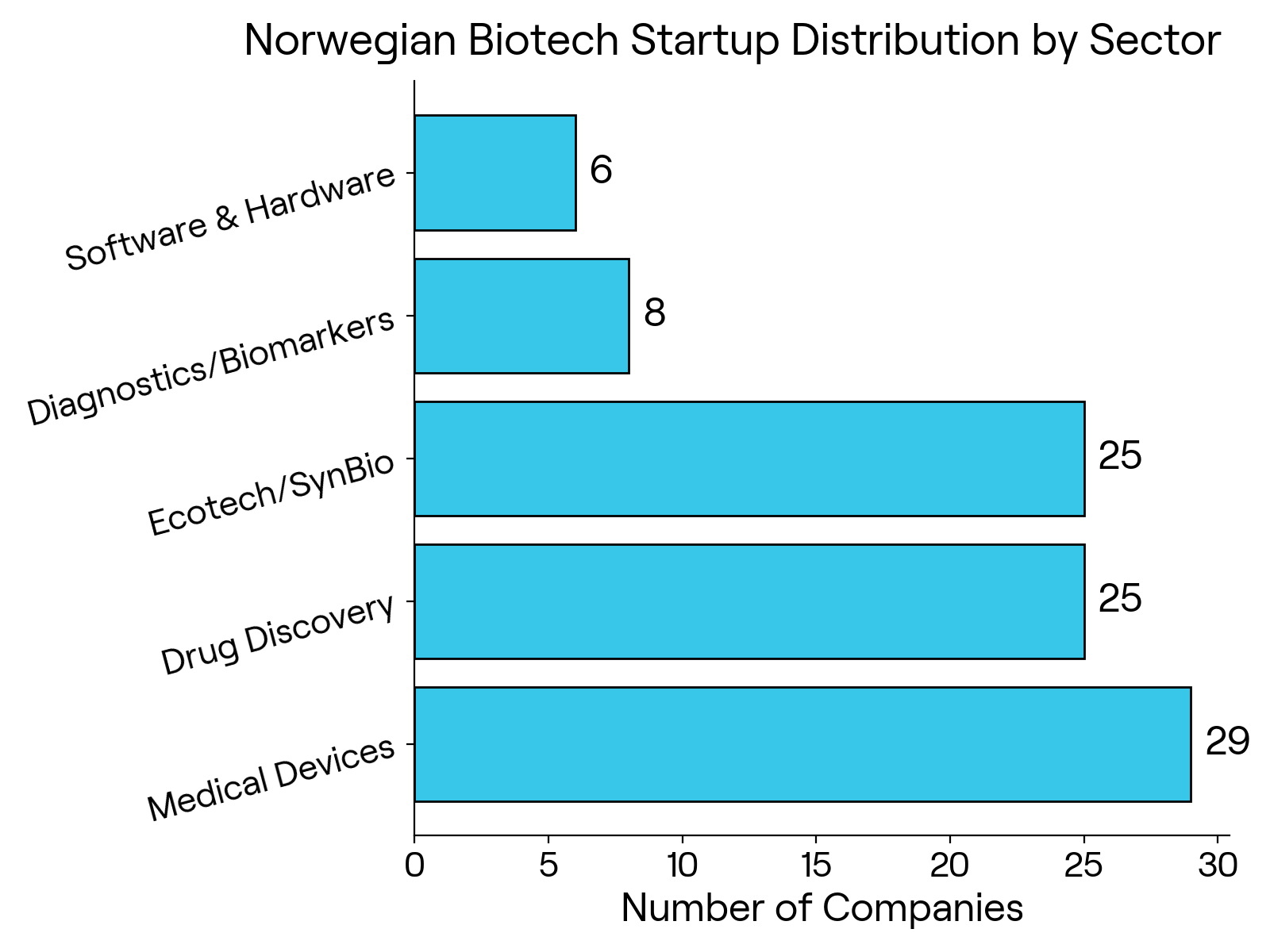

- Norway’s biotech growth is centered on medical devices and eco-tech, reflecting a pivot from its oil legacy to sustainable innovation (Figure 2).

Written by Eva Smorodina & Aibek Kappassov

Edited by Lauren Stanwicks

Turning breakthrough science into a biotech company is a challenging process. From navigating scientific complexity to adapting to current market conditions and funding challenges in traditional biotech hubs, we often overlook emerging ecosystems.

As part of Nucleate’s Inside Global Life Sciences series, we explored the Nordic biotech ecosystem and discussed emerging opportunities in Denmark and Norway with Markus Herrgård and Andy Boyce. Expanding on the discussion, this article takes a deeper look at the life science scene and investment landscape in both countries.

Denmark: Pharmaceutical Legacy and Accessible Capital

With the Ozempic boom, Denmark has emerged as a global pharmaceutical power. (Figure 1). While Novo Nordisk drove two-thirds of the 2022 GDP growth, the country’s drug discovery scene extends far beyond that. Denmark is also home to other major pharmaceutical players, including Leo Pharma, Lundbeck, and Genmab, along with Medicon Valley, a major European biotech hub, and leading research institutions such as the Technical University of Denmark and the University of Copenhagen, which together create a unique environment for innovation.

Markus Herrgård serves as the CTO at the Bioinnovation Institute (BII), a Copenhagen-based non-profit foundation. BII has served as an incubator space for 130 startups over the past seven years. With an active portfolio of more than 70 companies and approximately 25 new investments each year, BII helps early-stage founders bring academic research from bench to market.

Large foundations, such as BII, play a crucial role in Denmark’s investment landscape. According to Markus, having these foundations, which lead many research initiatives typically managed by the government, sets Denmark apart from other ecosystems. A key example, he notes, is the Novo Nordisk Foundation, which supports academic research throughout the Nordics, creating opportunities for biotech startups in the region. Additionally, the Export and Investment Fund of Denmark (EIFO) also invests in biotech startups as part of the broader government strategy. These efforts are supported by government initiatives aimed at lowering the barrier to starting and running a company, particularly for early-stage ventures. BII also runs its own acceleration program called Venture Lab. Nucleate Denmark is another initiative Mark is excited about:

“It’s a great vehicle for early-stage science commercialization. We appreciate and enjoy collaborating with Nucleate, both in Denmark and globally.”

Building on Denmark’s pharma legacy, Markus noted a trend in venture funding over the past 5-10 years toward eco-tech, especially in food, agtech, chemicals, and sustainable materials, as well as quantum technologies.

Norway: From Oil to Eco-Tech

Unlike Denmark, Norway’s ecosystem has developed without major homegrown biotech companies like Novo Nordisk, resulting in less industry and venture pull for early-stage biotech startups, says Andy Boyce. Andy is a senior advisor at the Centre for Digital Life Norway (DLN), a national biotech research and innovation center formed through collaboration among top Norwegian universities to support biotech innovation. Andy views the sovereign wealth fund (~$1.95 trillion) as Norway’s unique advantage, potentially supporting a wide range of initiatives in eco-tech and sustainable biotech infrastructure, even though it does not have the same direct innovation flow as Denmark. In Andy’s words:

“Norway has great potential to shape its biotech landscape, and organizations like ours have a role in incentivizing progress.”

The progress is already visible, as Norway’s ecosystem is expanding with new accelerator programs such as the DNB//Back Bay Healthcare Accelerator and the Forge. Moreover, Nucleate Norway’s launch event in June marked an important milestone in the Norwegian life sciences scene, as it brought together industry and academic leaders, innovative startups, and venture capital firms for the first time.

We analyzed the current landscape of Norwegian biotech startups to identify key drivers of growth and innovation (Figure 2). Norway has traditionally had a distinct strength in the medical devices sector and a strong reputation in cancer research, supported by flagship institutions like the Oslo Cancer Cluster and the Institute for Cancer Research. Nucleate Norway’s launch featured talks from immunotherapy startups Cellmover and Authera, as well as Victor Greiff, whose lab recently partnered with Danish biotech Genmab, a leader in antibody-based therapeutics. However, the local ecosystem is rapidly expanding into the eco-tech sector. While having a deep-rooted connection with the oil industry, the country’s new generation of startups is developing scalable solutions to the biggest sustainability challenges.

In biomaterials, companies like CellON are developing biobased shields as alternatives to toxic, non-biodegradable PFAS and plastics, while Ocean TuniCell produces medical fibers from sea organisms called tunicates. Bioregion Institute focuses on marine regenerative habitats and mycelium-based building materials, and Greentech Innovators uses enzymes to extract nutrients from food waste for microbial cultivation.

In food tech, startups such as Moreshrooms produce carbon-negative mycoprotein from seaweed, Norwegian Mycelium (NoMy) creates high-value protein and fiber ingredients using fungal mycelium, and SifoTEK engineers yeast to produce cow-identical milk proteins. Additionally, Syngens offers an AI-powered DNA Design Platform for precise and sustainable DNA engineering, while Carbon Dynamics develops next-generation carbon capture by engineering microbes to convert CO₂ into high-demand products.

Based on our dataset, the leading startup sectors in Norway are medical devices, drug discovery, and eco-tech. With approximately 30% of startups targeting the eco-tech sector, this distribution reflects a clear pivot towards a sustainable future. While the local ecosystem is limited in size and internal funding, Norwegian eco-tech startups are already developing impact-focused solutions across various categories, including biomaterials and foodtech.

Nordics Biotech Landscape

The Danish biotech ecosystem’s growth stems largely from a strong pharma foundation and robust funding, creating a clear model for early-stage startups in an accessible environment. Norway, by comparison, is cultivating its own smaller, distinct ecosystem, leveraging its strengths in sustainability and eco-tech sectors. Both countries showcase the potential for long-term innovation and pave the way for other Nordic nations.

As cross-border collaborations grow, the broader Nordic ecosystem has the opportunity to define the next wave of sustainable biotech innovation. At Nucleate, we are approaching this next chapter with excitement. With the support of our regional teams in Copenhagen and Oslo, we aim to shape a diverse biotech landscape across the region.

References

Articles and Videos

- Bloomberg. Novo Nordisk’s Growth Camouflages Weak Spots in Danish Economy. https://www.bloomberg.com/news/articles/2023-08-11/novo-nordisk-s-growth-camouflages-weak-spots-in-danish-economy

- Fortune. Novo Nordisk’s market value of $570 billion is now bigger than the entire Danish economy - creating a ‘Nokia risk’ for Denmark. https://fortune.com/europe/2024/05/01/novo-nordisk-market-value-570-billion-bigger-than-danish-denmark-economy/

- Institute of Clinical Medicine. AI-driven collaboration aims to transform antibody-based medication. https://www.med.uio.no/klinmed/english/about/news-and-events/news/2024/ai-driven-collaboration-aims-to-transform-antibody-based-medication.html

- Nucleate. Nucleate Global Life Sciences - Denmark x Norway. https://www.youtube.com/watch?v=Wjg03GnegcM&t=566s

Institutional Sources

- Bioinnovation Institute. https://bii.dk/about/

- Novo Nordisk Foundation. https://novonordiskfonden.dk/en/who-we-are/

- Medicon Valley Alliance. https://mva.org/about-mva/medicon-valley-alliance/

- Export and Investment Fund of Denmark. https://www.eifo.dk/en/about/

- Centre for Digital Life Norway. https://www.digitallifenorway.org/about/

- DNB // Back Bay. https://www.dnb.no/en/business/industry-expertise/healthcare/dnb-back-bay

Norway-Based Startups and Labs

- Cellmover. https://www.cellmover.com/

- Authera. https://www.authera.bio/

- Victor Greiff Lab. https://greifflab.org/

- CellON. https://www.cellon.one/

- Ocean TuniCell. https://oceantunicell.com/about-us/

- Bioregion Institute. https://www.bioregion.institute/

- Greentech Innovators. https://www.greentechinnovators.no/

- Moreshrooms. https://more-shrooms.com/about-us

- Norwegian Mycelium. https://nomy.no/about/

SifoTEK. https://sifotek.com/